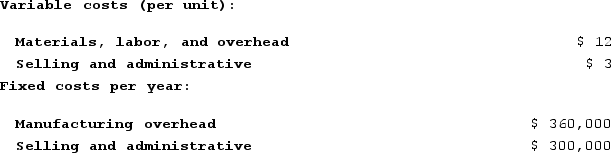

Mercer Corporation estimates that an investment of $650,000 would be necessary to produce and sell 60,000 units of a new product each year. Other costs associated with the new product would be:  The company requires a 25% return on the investment in all products. The company uses the absorption costing approach costing to pricing as described in the text.The selling price would be closest to:

The company requires a 25% return on the investment in all products. The company uses the absorption costing approach costing to pricing as described in the text.The selling price would be closest to:

Definitions:

Dreaming

A series of thoughts, images, and sensations occurring in a person's mind during sleep.

REM Sleep

A phase of sleep characterized by rapid eye movement, increased brain activity, vivid dreams, and temporary muscle paralysis.

Non-REM Sleep

A period of sleep that includes stages 1 through 3, characterized by gradual decreases in brain activity and physiological arousal.

Minutes

The written record of what was discussed and decided in a meeting, capturing the key points, decisions, and actions to be taken.

Q94: Which of the following would be classified

Q105: Part S51 is used in one of

Q116: Which of the following would be classified

Q123: Which of the following would be classified

Q130: In value-based pricing, the economic value to

Q162: The Carter Corporation makes products A and

Q179: Lusk Corporation produces and sells 16,100 units

Q197: Robichau Incorporated reported the following results from

Q222: Babak Industries is a division of a

Q306: Shilt Corporation is considering a capital budgeting