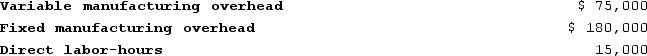

Mcniff Corporation makes a range of products. The company's predetermined overhead rate is $17 per direct labor-hour, which was calculated using the following budgeted data:

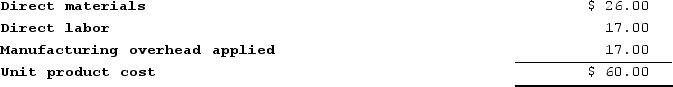

Management is considering a special order for 590 units of product O96S at $53 each. The normal selling price of product O96S is $64 and the unit product cost is determined as follows:

Management is considering a special order for 590 units of product O96S at $53 each. The normal selling price of product O96S is $64 and the unit product cost is determined as follows:

If the special order were accepted, normal sales of this and other products would not be affected. The company has ample excess capacity to produce the additional units. Assume that direct labor is a variable cost, variable manufacturing overhead is really driven by direct labor-hours, and total fixed manufacturing overhead would not be affected by the special order.Required:The financial advantage (disadvantage) for the company as a result of accepting this special order would be:

If the special order were accepted, normal sales of this and other products would not be affected. The company has ample excess capacity to produce the additional units. Assume that direct labor is a variable cost, variable manufacturing overhead is really driven by direct labor-hours, and total fixed manufacturing overhead would not be affected by the special order.Required:The financial advantage (disadvantage) for the company as a result of accepting this special order would be:

Definitions:

Q43: Ecob Corporation uses the absorption costing approach

Q72: Harwood Company's quality cost report is to

Q101: Houze Corporation has provided the following information

Q124: Dock Corporation makes two products from a

Q196: In target costing, the cost of a

Q229: Hill Corporation is contemplating the introduction of

Q239: Mcniff Corporation makes a range of products.

Q252: Inscho Corporation manufactures numerous products, one of

Q277: Bellows Corporation is considering a capital budgeting

Q422: The book value of an old machine