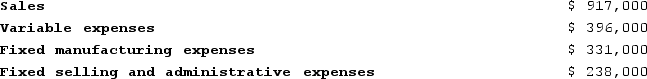

The management of Bonga Corporation is considering dropping product D74F. Data from the company's accounting system for this product for last year appear below:  All fixed expenses of the company are fully allocated to products in the company's accounting system. Further investigation has revealed that $198,000 of the fixed manufacturing expenses and $109,000 of the fixed selling and administrative expenses are avoidable if product D74F is discontinued.According to the company's accounting system, what is the net operating income (loss) earned by product D74F? Include all costs in this calculation-whether relevant or not.

All fixed expenses of the company are fully allocated to products in the company's accounting system. Further investigation has revealed that $198,000 of the fixed manufacturing expenses and $109,000 of the fixed selling and administrative expenses are avoidable if product D74F is discontinued.According to the company's accounting system, what is the net operating income (loss) earned by product D74F? Include all costs in this calculation-whether relevant or not.

Definitions:

Business Combination

The process of merging two or more companies into one entity, which includes acquisitions and consolidations.

Pooling of Interest Method

An accounting method used in mergers and acquisitions, where the combined assets and liabilities of the merging entities are recorded at their historical costs.

GAAP

Generally Accepted Accounting Principles; a collection of commonly-followed accounting rules and standards for financial reporting.

Business Combinations

Transactions in which one entity gains control over another and they are combined into one entity, often involving mergers, acquisitions, or consolidations.

Q36: Which of the following would be classified

Q39: Which of the following would be classified

Q105: Throughput time is the amount of time

Q111: The management of Leitheiser Corporation is considering

Q121: Lambert Manufacturing has $120,000 to invest in

Q126: Garson, Incorporated produces three products. Data concerning

Q138: Two or more products that are produced

Q187: Schickel Incorporated regularly uses material B39U and

Q272: Alway Candy Corporation is implementing a target

Q386: Boynes Corporation is considering a capital budgeting