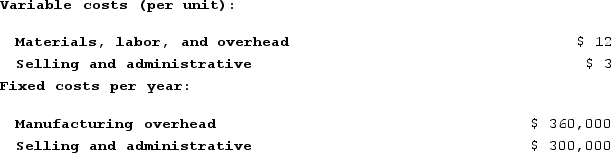

Mercer Corporation estimates that an investment of $650,000 would be necessary to produce and sell 60,000 units of a new product each year. Other costs associated with the new product would be:  The company requires a 25% return on the investment in all products. The company uses the absorption costing approach costing to pricing as described in the text.The markup percentage on the new product would be closest to:

The company requires a 25% return on the investment in all products. The company uses the absorption costing approach costing to pricing as described in the text.The markup percentage on the new product would be closest to:

Definitions:

Profitability Index

A financial metric that measures the relative profitability of an investment, calculated as the present value of future cash flows divided by the initial investment cost.

Investment Projects

Initiatives undertaken by companies or individuals to allocate capital in ways expected to yield returns or gains over time, such as purchasing new equipment or expanding operations.

Income Taxes

Taxes imposed by government authorities on the income earned by companies and individuals, a significant component of fiscal policy.

Internal Rate

Often referring to the internal rate of return (IRR), which is the discount rate that makes the net present value of all cash flows from a particular project equal to zero.

Q104: Halpert Corporation has been in operation for

Q114: Prudencio Corporation has provided the following information

Q116: A company needs an increase in working

Q137: The Millard Division's operating data for the

Q150: Penagos Corporation is presently making part Z43

Q167: When used in return on investment (ROI)

Q190: Residual income is the difference between net

Q204: An avoidable fixed production cost incurred before

Q228: Meers Products, Incorporated, has a Detector Division

Q244: Robichau Incorporated reported the following results from