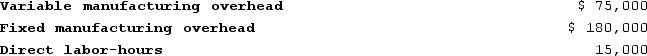

Mcniff Corporation makes a range of products. The company's predetermined overhead rate is $17 per direct labor-hour, which was calculated using the following budgeted data:

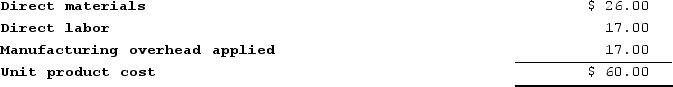

Management is considering a special order for 590 units of product O96S at $53 each. The normal selling price of product O96S is $64 and the unit product cost is determined as follows:

Management is considering a special order for 590 units of product O96S at $53 each. The normal selling price of product O96S is $64 and the unit product cost is determined as follows:

If the special order were accepted, normal sales of this and other products would not be affected. The company has ample excess capacity to produce the additional units. Assume that direct labor is a variable cost, variable manufacturing overhead is really driven by direct labor-hours, and total fixed manufacturing overhead would not be affected by the special order.Required:The financial advantage (disadvantage) for the company as a result of accepting this special order would be:

If the special order were accepted, normal sales of this and other products would not be affected. The company has ample excess capacity to produce the additional units. Assume that direct labor is a variable cost, variable manufacturing overhead is really driven by direct labor-hours, and total fixed manufacturing overhead would not be affected by the special order.Required:The financial advantage (disadvantage) for the company as a result of accepting this special order would be:

Definitions:

Cash Balance

The amount of cash on hand at a given time, reflecting the liquidity position of an entity, as recorded in the financial statements.

Petty Cash Fund

A small amount of cash kept on hand for making immediate, low-value payments instead of writing checks.

Transportation-In

Costs associated with bringing inventory to a business, which are often added to the purchase price of goods.

Office Supplies

Various everyday items used in offices for tasks such as writing, organization, and communication, including pens, paper, and staplers.

Q2: Wetherald Products, Incorporated, has a Pump Division

Q4: Fabrick Company's quality cost report is to

Q44: Fois Company has two divisions, Division X

Q160: Herrell Corporation manufactures numerous products, one of

Q175: Hinger Corporation is considering a capital budgeting

Q202: Mittan Products, Incorporated, has a Antennae Division

Q216: Planas Corporation has provided the following information

Q236: The following information relates to next year's

Q240: The management of Nixon Corporation is investigating

Q315: When a dispute arises over a transfer