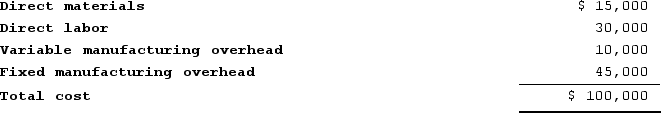

McGraw Company uses 5,000 units of Part X each year as a component in the assembly of one of its products. The company is presently producing Part X internally at a total cost of $100,000, computed as follows:

An outside supplier has offered to provide Part X at a price of $18 per unit. If McGraw Company stops producing the part internally, one-third of the fixed manufacturing overhead would be eliminated. Assume that direct labor is a variable cost.Required:Prepare an analysis showing the annual financial advantage or disadvantage of accepting the outside supplier's offer.

An outside supplier has offered to provide Part X at a price of $18 per unit. If McGraw Company stops producing the part internally, one-third of the fixed manufacturing overhead would be eliminated. Assume that direct labor is a variable cost.Required:Prepare an analysis showing the annual financial advantage or disadvantage of accepting the outside supplier's offer.

Definitions:

Enterprising Nonprofits

Organizations that adopt entrepreneurial strategies and innovations in pursuit of social, cultural, or environmental missions.

Complete Financing

The process of providing all necessary funds for a project or business endeavor, covering all anticipated costs.

Wicked Problems

Complex challenges characterized by high levels of uncertainty, interconnectedness, and the absence of a single, straightforward solution.

Access To Capital

The ability of a business or individual to obtain financial resources and funding necessary for operations, expansion, or investment.

Q2: Wary Corporation is considering the purchase of

Q44: Fois Company has two divisions, Division X

Q59: Wetherald Products, Incorporated, has a Pump Division

Q62: The Tipton Division of Dudley Company reported

Q82: Mattice Corporation is considering investing $440,000 in

Q222: Babak Industries is a division of a

Q241: Sester Corporation has provided the following information

Q257: Weakly Industrial Products Incorporated has developed a

Q307: In November, the Universal Solutions Division of

Q327: All other things equal, which of the