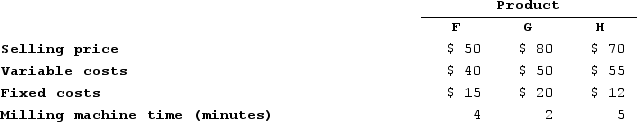

Garson, Incorporated produces three products. Data concerning the selling prices and unit costs of the three products appear below:

Fixed costs are applied to the products on the basis of direct labor hours.Demand for the three products exceeds the company's productive capacity. The milling machine is the constraint, with only 2,400 minutes of milling machine time available this week.Required:a. Given the milling machine constraint, which product should be emphasized?b. Assuming that there is still unfilled demand for the product that the company should emphasize in part (a) above, up to how much should the company be willing to pay for an additional hour of milling machine time?

Fixed costs are applied to the products on the basis of direct labor hours.Demand for the three products exceeds the company's productive capacity. The milling machine is the constraint, with only 2,400 minutes of milling machine time available this week.Required:a. Given the milling machine constraint, which product should be emphasized?b. Assuming that there is still unfilled demand for the product that the company should emphasize in part (a) above, up to how much should the company be willing to pay for an additional hour of milling machine time?

Definitions:

Weighted-Average Method

An inventory costing method that calculates the cost of goods sold and ending inventory based on the average cost of all items available for sale during the period.

First-In, First-Out Methods

An inventory valuation method where the first items produced or purchased are the first ones sold, affecting the cost of goods sold and inventory valuation.

First-In, First-Out Method

An inventory valuation method where the first items placed into inventory are the first ones sold.

Weighted-Average Method

An inventory costing method that calculates the cost of inventory based on the average cost of all similar items in the inventory, considering their weight.

Q12: Part U67 is used in one of

Q21: The Melville Corporation produces a single product

Q82: Blauvelt Electronics Corporation has developed a new

Q113: United Industries manufactures a number of products

Q120: Bohmker Corporation is introducing a new product

Q161: The constraint at Dreyfus Incorporated is an

Q188: The following data pertain to Turk Company's

Q195: The Tolar Corporation has 400 obsolete desk

Q306: Farrugia Corporation produces two intermediate products, A

Q403: Donayre Corporation is considering a capital budgeting