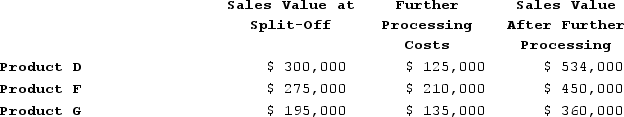

Prosner Corporation manufactures three products from a common input in a joint processing operation. Joint processing costs up to the split-off point total $500,000 per year. The company allocates these costs to the joint products on the basis of their total sales value at the split-off point.Each product may be sold at the split-off point or processed further. The additional processing costs and sales value after further processing for each product (on an annual basis) are:

Required: Which product or products should be sold at the split-off point, and which product or products should be processed further?

Required: Which product or products should be sold at the split-off point, and which product or products should be processed further?

Definitions:

Snickers Candy Bars

A popular brand of candy bar consisting of nougat topped with caramel and peanuts, enrobed in milk chocolate.

Falls 10%

A term indicating a decrease in a value, such as stock prices or GDP, by 10% from its previous level.

Camel Cigarette

A brand of cigarettes that was originally developed by the R.J. Reynolds Tobacco Company in the United States, known for its distinct packaging and marketing.

Elasticity of Demand

A measure of how much the quantity demanded of a good responds to a change in its price, indicating the sensitivity of consumers to price changes.

Q19: A manufacturing cycle efficiency (MCE) of less

Q34: Frame Corporation's Maintenance Department provides services to

Q159: Ahart Products, Incorporated, has a Transmitter Division

Q159: Wehrs Corporation has received a request for

Q177: The basic objective of responsibility accounting is

Q186: Erholm Corporation has two operating divisions-an Atlantic

Q233: Division A makes a part with the

Q248: Gauntlett Incorporated reported the following results from

Q329: In a special order situation that involves

Q410: The constraint at Pickrel Corporation is time