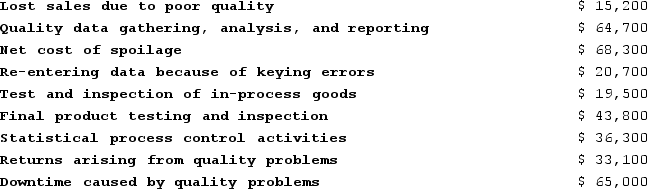

Fabrick Company's quality cost report is to be based on the following data:  What would be the total appraisal cost appearing on the quality cost report?

What would be the total appraisal cost appearing on the quality cost report?

Definitions:

Salaries

Payments made to employees for their labor or services over a period.

Social Security Tax

Definition: Taxes collected by governments to fund social security programs, typically levied on both employers and employees.

Medicare Tax

A federal tax taken from earnings to fund the Medicare program, which provides health insurance for individuals aged 65 and older.

Employer Payroll Taxes

Taxes that employers are required to pay on behalf of their employees, including contributions to social security, Medicare, and unemployment taxes.

Q55: Brodrick Corporation uses residual income to evaluate

Q142: Ghia Manufacturing Corporation charges its Maintenance Department's

Q185: Agustin Industries is a division of a

Q202: Mittan Products, Incorporated, has a Antennae Division

Q238: Fregozo Products, Incorporated, has a Connector Division

Q254: Morice Industries Incorporated has developed a new

Q282: A disadvantage of vertical integration is that

Q300: Tommasino Products, Incorporated, has a Motor Division

Q361: Lusk Corporation produces and sells 10,000 units

Q369: Minden Corporation estimates that the following costs