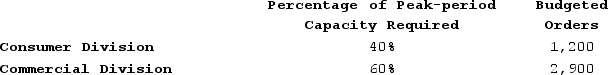

Azotea Corporation has two operating divisions-a Consumer Division and a Commercial Division. The company's Order Fulfillment Department provides services to both divisions. The variable costs of the Order Fulfillment Department are budgeted at $56 per order. The Order Fulfillment Department's fixed costs are budgeted at $233,700 for the year. The fixed costs of the Order Fulfillment Department are budgeted based on the peak-period orders.  At the end of the year, actual Order Fulfillment Department variable costs totaled $237,390 and fixed costs totaled $239,140. The Consumer Division had a total of 1,240 orders and the Commercial Division had a total of 2,860 orders for the year.How much Order Fulfillment Department cost should be allocated to the Commercial Division at the end of the year?

At the end of the year, actual Order Fulfillment Department variable costs totaled $237,390 and fixed costs totaled $239,140. The Consumer Division had a total of 1,240 orders and the Commercial Division had a total of 2,860 orders for the year.How much Order Fulfillment Department cost should be allocated to the Commercial Division at the end of the year?

Definitions:

Fixed Overhead Budget Variance

The difference between the budgeted and actual fixed overhead costs incurred during a specified period.

Fixed Manufacturing Overhead

Costs that do not vary with the level of production, such as rent, salaries of permanent staff, and depreciation of factory equipment.

Fixed Overhead Volume Variance

The difference between the budgeted and actual fixed overhead costs attributed to the variation in produced units.

Materials Price Variance

The difference between the actual cost of materials and the standard cost, which can indicate inefficiencies or savings.

Q37: Information on Westcott Corporation's direct labor costs

Q73: Rigoletto Company's quality cost report is to

Q115: If skilled workers with high hourly rates

Q135: Trendell Products, Incorporated, has a Motor Division

Q171: Saulsberry Corporation manufactures numerous products, one of

Q189: Milar Corporation makes a product with the

Q202: Mittan Products, Incorporated, has a Antennae Division

Q272: A change in sales has no effect

Q299: The following data has been provided for

Q443: Piper Corporation's standards call for 1,000 direct