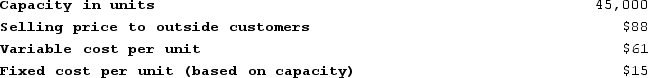

Stibbins Products, Incorporated, has a Receiver Division that manufactures and sells a number of products, including a standard receiver. Data concerning that receiver appear below:

The company has a Industrial Products Division that could use this receiver in one of its products. The Industrial Products Division is currently purchasing 6,000 of these receivers per year from an overseas supplier at a cost of $79 per receiver.

The company has a Industrial Products Division that could use this receiver in one of its products. The Industrial Products Division is currently purchasing 6,000 of these receivers per year from an overseas supplier at a cost of $79 per receiver.

Required:

a. Assume that the Receiver Division is selling all of the receivers it can produce to outside customers. What is the acceptable range, if any, for the transfer price between the two divisions?

b. Assume again that the Receiver Division is selling all of the receivers it can produce to outside customers. Also assume that $13 in variable expenses can be avoided on transfers within the company due to reduced shipping and selling costs. What is the acceptable range, if any, for the transfer price between the two divisions?

Definitions:

Mother's Language

The native language spoken by one's mother, often the first language a child is exposed to and learns.

Babbling

The production of speech-like but meaningless sounds, commonly practiced by infants as a precursor to the development of language.

Months

Units of time in calendars that approximate the period of the Moon's orbit around the Earth, typically involving divisions of the year into twelve parts.

Me-Me-Me-Me-Me

Expresses an excessive focus on oneself, often indicative of narcissism or selfishness.

Q15: Mannerman Products, Incorporated, operates an electric power

Q15: A physician orders a total nutrient admixture

Q18: Vandenheuvel Corporation keeps careful track of the

Q29: Pankey Incorporated has a $700,000 investment opportunity

Q84: Cleland Corporation manufactures one product. It does

Q126: Samples Corporation manufactures one product. It does

Q217: A segment of a business responsible for

Q256: The standards for product V28 call for

Q395: Bohon Corporation manufactures one product. It does

Q402: Hykes Corporation's manufacturing overhead includes $5.10 per