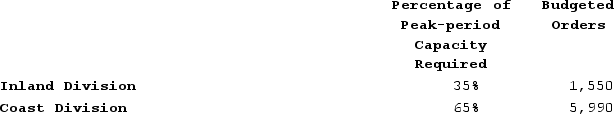

Sauseda Corporation has two operating divisions-an Inland Division and a Coast Division. The company's Customer Service Department provides services to both divisions. The variable costs of the Customer Service Department are budgeted at $30 per order. The Customer Service Department's fixed costs are budgeted at $474,000 for the year. The fixed costs of the Customer Service Department are determined based on the peak-period orders.

At the end of the year, actual Customer Service Department variable costs totaled $239,295 and fixed costs totaled $476,350. The Inland Division had a total of 1,585 orders and the Coast Division had a total of 5,940 orders for the year.

At the end of the year, actual Customer Service Department variable costs totaled $239,295 and fixed costs totaled $476,350. The Inland Division had a total of 1,585 orders and the Coast Division had a total of 5,940 orders for the year.

Required:a. Prepare a report showing how much of the Customer Service Department's costs should be charged to each of the operating divisions at the end of the year.b. How much of the actual Customer Service Department costs should not be charged to the operating divisions at the end of the year? Who should be held responsible for these uncharged costs?

Definitions:

Direct Labor Cost

The total cost of workforce directly involved in the production of goods or services, excluding indirect labor such as administration.

Variable Costing

A costing technique that only assigns variable production costs to inventory, helping managers understand the impact of production levels on total costs.

Net Operating Income

The income produced through a firm's regular commercial activities, not including taxes and interest.

Variable Costing

A record-keeping system in accounting that inputs only variable production-related expenses (direct materials, direct labor, and variable manufacturing overhead) into the cost evaluation of goods.

Q25: Irving Corporation makes a product with the

Q55: Milar Corporation makes a product with the

Q63: Alvino Corporation manufactures one product. It does

Q72: Azotea Corporation has two operating divisions-a Consumer

Q73: Rigoletto Company's quality cost report is to

Q95: The cost of labor time required to

Q133: Handerson Corporation makes a product with the

Q228: Meers Products, Incorporated, has a Detector Division

Q253: Puvo, Incorporated, manufactures a single product in

Q259: Shrewsbury Incorporated reported the following results from