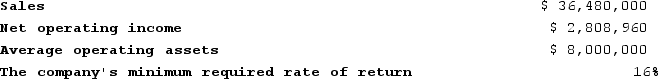

Dacker Products is a division of a major corporation. The following data are for the most recent year of operations:  The division's residual income is closest to:

The division's residual income is closest to:

Definitions:

Fixed Manufacturing Overhead

The total of all manufacturing costs that do not vary with the level of production, such as rent, salaries, and insurance.

Reconciliation

The process of ensuring that two sets of records or financial accounts are in agreement, often used in accounting to match transactions.

Super-Variable Costing

No real financial accounting term aligns exactly with "Super-Variable Costing"; may be a mistaken or niche term.

Variable Costing

An accounting method that considers only variable costs in determining the cost of goods sold and evaluates profitability.

Q34: Rotan Corporation keeps careful track of the

Q120: Bohmker Corporation is introducing a new product

Q160: Fingado Products, Incorporated, has a Detector Division

Q185: Agustin Industries is a division of a

Q185: Kartman Corporation makes a product with the

Q222: Signore Corporation uses a standard cost system

Q223: Isenberg Corporation manufactures one product. It does

Q318: Janeiro Skate, Incorporated currently manufactures the wheels

Q349: Contento Corporation manufactures numerous products, one of

Q449: The following materials standards have been established