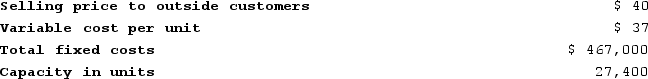

Division C makes a part that it sells to customers outside of the company. Data concerning this part appear below:  Division D of the same company would like to use the part manufactured by Division C in one of its products. Division D currently purchases a similar part made by an outside company for $39 per unit and would substitute the part made by Division C. Division D requires 5,810 units of the part each period. Division C has ample excess capacity to handle all of Division D's needs without any increase in fixed costs and without cutting into outside sales. What is the lowest acceptable transfer price from the standpoint of the selling division?

Division D of the same company would like to use the part manufactured by Division C in one of its products. Division D currently purchases a similar part made by an outside company for $39 per unit and would substitute the part made by Division C. Division D requires 5,810 units of the part each period. Division C has ample excess capacity to handle all of Division D's needs without any increase in fixed costs and without cutting into outside sales. What is the lowest acceptable transfer price from the standpoint of the selling division?

Definitions:

Economic Profit

The difference between total revenue and total costs, including both explicit and implicit costs, representing excess return over perfect competition.

Per-Unit Profit

The difference between the selling price of a product and its cost of production on a per-item basis, indicating the profit generated from selling one unit of product.

AVC

Average variable cost refers to the division of the total variable expenses by the quantity of goods produced.

ATC

Average Total Cost, which refers to the total cost per unit of output, including both fixed and variable costs.

Q11: Wollan Corporation has two operating divisions-an East

Q93: For management to be effective, it should

Q102: Which of the following would be classified

Q120: Division S of Kracker Company makes a

Q120: Which of the following would be classified

Q129: Beamer Corporation produces one product and it

Q136: Circle K Toys, Incorporated manufactures toys and

Q136: Nafth Company has an Equipment Services Department

Q313: Bulluck Corporation makes a product with the

Q395: Bohon Corporation manufactures one product. It does