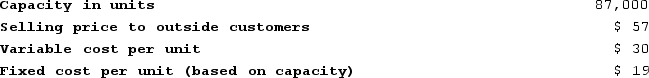

Ricardo Products, Incorporated has a Motor Division that manufactures and sells a number of products, including a standard motor. Data concerning that motor appear below:  The Automotive Division of Ricardo Products, Incorporated needs 10,000 special heavy-duty motors per year. The Motor Division's variable cost to manufacture and ship this special motor would be $35 per unit. Because these special motors require more manufacturing resources than the standard motor, the Motor Division would have to reduce its production and sales of standard motors to outside customers from 87,000 units per year to 69,000 units per year.What is the total contribution margin on sales to outside customers that the Motor Division would give up if it were to make the special motors for the Automotive Division?

The Automotive Division of Ricardo Products, Incorporated needs 10,000 special heavy-duty motors per year. The Motor Division's variable cost to manufacture and ship this special motor would be $35 per unit. Because these special motors require more manufacturing resources than the standard motor, the Motor Division would have to reduce its production and sales of standard motors to outside customers from 87,000 units per year to 69,000 units per year.What is the total contribution margin on sales to outside customers that the Motor Division would give up if it were to make the special motors for the Automotive Division?

Definitions:

Estimated Payments

Quarterly payments made towards the expected tax liability for the year, common for self-employed individuals or those without sufficient tax withholding.

Form 1040

The standard IRS form that individuals use to file their annual income tax returns.

Household Workers

Individuals employed within a private home to perform domestic tasks, such as cleaning, cooking, and childcare.

Quarterly 941 Return

A quarterly tax form employers file to report federal withholdings and Social Security and Medicare taxes for employees.

Q55: Halpert Corporation has been in operation for

Q100: Brull Products, Incorporated, has a Sensor Division

Q125: Robins Corporation manufactures one product. It does

Q141: Pinkton Corporation keeps careful track of the

Q181: Doogan Corporation makes a product with the

Q249: Agustin Industries is a division of a

Q313: Weitman Corporation manufactures numerous products, one of

Q329: The following data has been provided for

Q339: Saxena Corporation makes a product that has

Q453: Thyne Incorporated has provided the following data