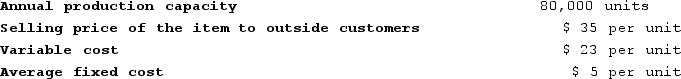

Division P of the Nyers Company makes a part that can either be sold to outside customers or transferred internally to Division Q for further processing. Annual data relating to this part are as follows:  Division Q of the Nyers Company requires 15,000 units per year and is currently paying an outside supplier $33 per unit. Consider each part below independently.If outside customers demand 80,000 units and if, by selling to Division Q, Division P could avoid $4 per unit in variable selling expense, then according to the formula in the text, what is the lowest acceptable transfer price from the viewpoint of the selling division?

Division Q of the Nyers Company requires 15,000 units per year and is currently paying an outside supplier $33 per unit. Consider each part below independently.If outside customers demand 80,000 units and if, by selling to Division Q, Division P could avoid $4 per unit in variable selling expense, then according to the formula in the text, what is the lowest acceptable transfer price from the viewpoint of the selling division?

Definitions:

Optimal Taxation

The theory or practice of determining the most efficient and effective way of levying taxes to generate government revenue with minimal economic distortion or inefficiency.

Excess Burden

The societal expense resulting from market inefficiency, which arises when supply and demand are not in balance.

Progressive

A term often used in the context of taxation or political ideology, indicating policies or stances that aim to redistribute resources from the more affluent to the less affluent.

Income Tax

Tax levied by a government directly on income, especially an annual tax on personal income.

Q59: Wetherald Products, Incorporated, has a Pump Division

Q160: Herrell Corporation manufactures numerous products, one of

Q191: Tennill Incorporated has a $1,400,000 investment opportunity

Q221: Doogan Corporation makes a product with the

Q222: Signore Corporation uses a standard cost system

Q241: Mangrum Corporation manufactures one product. It does

Q254: Morice Industries Incorporated has developed a new

Q297: Bacot Products, Incorporated, has a Valve Division

Q382: Lemke Corporation uses a standard cost system

Q400: Devoto Incorporated has provided the following data