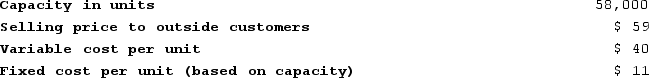

Yearout Products, Incorporated, has a Valve Division that manufactures and sells a number of products, including a standard valve that could be used by another division in the company, the Pump Division, in one of its products. Data concerning that valve appear below:  The Pump Division is currently purchasing 9,000 of these valves per year from an overseas supplier at a cost of $53 per valve.Assume that the Valve Division is selling all of the valves it can produce to outside customers. Also assume that $1 in variable expenses can be avoided on transfers within the company due to reduced shipping and selling costs. Does there exist a transfer price that would make both the Valve and Pump Division financially better off than if the Pump Division were to continue buying its valves from the outside supplier?

The Pump Division is currently purchasing 9,000 of these valves per year from an overseas supplier at a cost of $53 per valve.Assume that the Valve Division is selling all of the valves it can produce to outside customers. Also assume that $1 in variable expenses can be avoided on transfers within the company due to reduced shipping and selling costs. Does there exist a transfer price that would make both the Valve and Pump Division financially better off than if the Pump Division were to continue buying its valves from the outside supplier?

Definitions:

Line Management

Managers directly responsible for the production and delivery of a company's products or services.

Staff Management

The function of leading, organizing, and supervising employees to achieve organizational goals efficiently and effectively.

Indirect Responsibilities

Duties or obligations not directly tied to one's primary job function but essential for supporting broader organizational goals.

Value Creation

Value Creation involves processes or activities that increase the worth of a product or service, enhancing its value to consumers and leading to competitive advantage.

Q7: The corporate social responsibility measure of "Average

Q76: Ralph Plastics Equipment Corporation has developed a

Q78: The following labor standards have been established

Q88: Beamer Corporation produces one product and it

Q105: Throughput time is the amount of time

Q117: Eagleson Company's quality cost report is to

Q185: Kartman Corporation makes a product with the

Q207: Arena Corporation manufactures one product. It does

Q290: Division A of Tripper Company produces a

Q335: Quamma Corporation makes a product that has