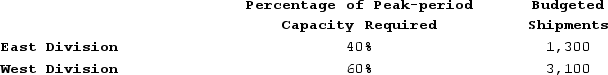

Wollan Corporation has two operating divisions-an East Division and a West Division. The company's Logistics Department services both divisions. The variable costs of the Logistics Department are budgeted at $44 per shipment. The Logistics Department's fixed costs are budgeted at $237,600 for the year. The fixed costs of the Logistics Department are determined based on peak-period demand.  At the end of the year, actual Logistics Department variable costs totaled $332,880 and fixed costs totaled $253,960. The East Division had a total of 4,300 shipments and the West Division had a total of 3,000 shipments for the year.How much Logistics Department cost should be allocated to the West Division at the end of the year?

At the end of the year, actual Logistics Department variable costs totaled $332,880 and fixed costs totaled $253,960. The East Division had a total of 4,300 shipments and the West Division had a total of 3,000 shipments for the year.How much Logistics Department cost should be allocated to the West Division at the end of the year?

Definitions:

Supplies Expense

Costs incurred for items used in the operation of a business, not directly tied to the production of goods or services.

Journalize

The process of recording transactions in the journal, a step in the accounting cycle that precedes posting to ledgers.

Transaction Recording

The process of documenting financial transactions in appropriate accounting records, ensuring accurate financial reporting.

Office Equipment

Assets such as computers, desks, and chairs used in an office setting, which are subject to depreciation over time.

Q5: The corporate social responsibility measure of "Percent

Q8: Edith Carolina is president of the Deed

Q11: Wollan Corporation has two operating divisions-an East

Q62: The following standards for variable manufacturing overhead

Q83: The following data for November have been

Q110: Which of the following would be classified

Q146: The Clipper Corporation had net operating income

Q151: If improvement in a performance measure on

Q198: Division P of the Nyers Company makes

Q228: Isaman Corporation uses a standard cost system