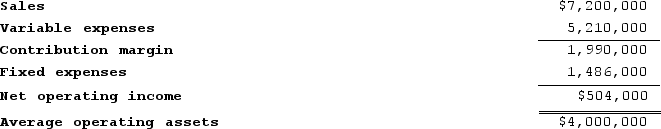

Wolley Incorporated reported the following results from last year's operations:

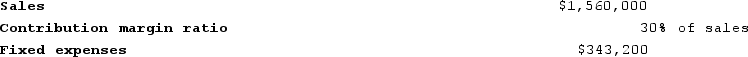

At the beginning of this year, the company has a $1,200,000 investment opportunity with the following characteristics:

At the beginning of this year, the company has a $1,200,000 investment opportunity with the following characteristics:

The company's minimum required rate of return is 14%.

The company's minimum required rate of return is 14%.

Required:

1. What was last year's margin? (Round to the nearest 0.1%.)

2. What was last year's turnover? (Round to the nearest 0.01.)

3. What was last year's return on investment (ROI)? (Round to the nearest 0.1%.)

4. What is the margin related to this year's investment opportunity? (Round to the nearest 0.1%.)

5. What is the turnover related to this year's investment opportunity? (Round to the nearest 0.01.)

6. What is the return on investment related to this year's investment opportunity? (Round to the nearest 0.1%.)

7. If the company pursues the investment opportunity and otherwise performs the same as last year, what will be the overall margin this year? (Round to the nearest 0.1%.)

8. If the company pursues the investment opportunity and otherwise performs the same as last year, what will be the overall turnover this year? (Round to the nearest 0.01.)

9. If the company pursues the investment opportunity and otherwise performs the same as last year, what will be the overall return on investment will this year? (Round to the nearest 0.1%.)

10. If Westerville's chief executive officer earns a bonus only if the return on investment for this year exceeds the return on investment for last year, would the chief executive officer pursue the investment opportunity? Would the owners of the company want the chief executive officer to pursue the investment opportunity?

Definitions:

Avoidance Learning

A learning process in which an individual learns a behavior or response to avoid an unpleasant or harmful stimulus.

Aversive Event

An unpleasant or undesirable event that causes a negative reaction in an individual, often used in psychology to study behaviors and conditioning.

Organism

A living entity that can function independently, including animals, plants, fungi, microorganisms, and in some contexts, viruses.

Punishment Learning

A form of learning in which an undesirable behavior decreases in frequency because it is followed by an unpleasant stimulus.

Q10: Which of the following would be classified

Q12: Part U67 is used in one of

Q34: Elliott Corporation makes and sells a single

Q72: Azotea Corporation has two operating divisions-a Consumer

Q114: Wigelsworth Products, Incorporated, has a Sensor Division

Q140: Circle K Toys, Incorporated manufactures toys and

Q171: Zeilinger Products, Incorporated, has a Screen Division

Q263: If net operating income is $39,000, average

Q278: Pleiss Corporation applies manufacturing overhead to products

Q287: Kartman Corporation makes a product with the