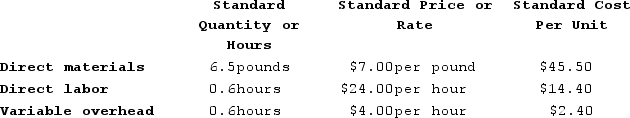

Kartman Corporation makes a product with the following standard costs:  In June the company's budgeted production was 3,400 units but the actual production was 3,500 units. The company used 22,150 pounds of the direct material and 2,290 direct labor-hours to produce this output. During the month, the company purchased 25,400 pounds of the direct material at a cost of $170,180. The actual direct labor cost was $57,021 and the actual variable overhead cost was $8,931.The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased.The materials price variance for June is:

In June the company's budgeted production was 3,400 units but the actual production was 3,500 units. The company used 22,150 pounds of the direct material and 2,290 direct labor-hours to produce this output. During the month, the company purchased 25,400 pounds of the direct material at a cost of $170,180. The actual direct labor cost was $57,021 and the actual variable overhead cost was $8,931.The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased.The materials price variance for June is:

Definitions:

Unearned Ticket Revenue

Income received by a company for goods or services to be delivered or performed in the future; it is considered a liability until the service is performed or goods are delivered.

Adjusting Entries

At the close of a fiscal period, entries recorded to assign revenue and costs to the actual period of occurrence.

Advance Rent

Prepaid rent, which is an amount paid prior to the period to which it relates, often accounted for as a current asset until the period to which the rent applies.

Utility Bill

A bill sent by a utility company (electricity, gas, water, etc.) charging the customer for their usage of the service.

Q2: Wetherald Products, Incorporated, has a Pump Division

Q40: Bondi Corporation makes automotive engines. For the

Q99: Chhom Corporation makes a product whose direct

Q108: Division A makes a part with the

Q113: The corporate social responsibility measure of "Percent

Q170: Using the formula in the text, if

Q184: Pearlman Incorporated makes a single product--an electrical

Q286: A product's standard cost card specifies that

Q410: The standard price per unit for direct

Q412: Kita Corporation manufactures one product. It does