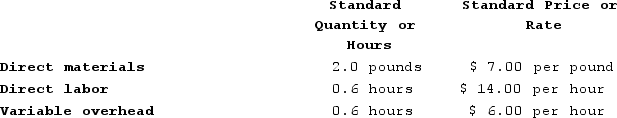

Milar Corporation makes a product with the following standard costs:  In January the company produced 4,600 units using 10,120 pounds of the direct material and 2,100 direct labor-hours. During the month, the company purchased 10,690 pounds of the direct material at a cost of $76,570. The actual direct labor cost was $38,256 and the actual variable overhead cost was $11,957.The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased.The materials price variance for January is:

In January the company produced 4,600 units using 10,120 pounds of the direct material and 2,100 direct labor-hours. During the month, the company purchased 10,690 pounds of the direct material at a cost of $76,570. The actual direct labor cost was $38,256 and the actual variable overhead cost was $11,957.The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased.The materials price variance for January is:

Definitions:

Claim Refusals

Instances when requests or demands are not granted or acknowledged positively, often in business or customer service contexts.

Warranty

A guarantee provided by a manufacturer or seller regarding the condition of a product and pledging to repair or replace it if necessary within a specified period.

Employee Morale

The overall outlook, attitude, satisfaction, and confidence that employees feel about their workplace.

Public Goodwill

Positive public perception or favor towards a person, organization, or brand, often built over time through ethical behavior and community engagement.

Q1: A nurse is teaching a client who

Q20: Documentation of initiation of a short-peripheral infusion

Q25: Zeilinger Products, Incorporated, has a Screen Division

Q148: The Downstate Block Company has a trucking

Q154: Pioli Corporation manufactures one product. It does

Q169: Ahart Products, Incorporated, has a Transmitter Division

Q215: Bialas Corporation uses a standard cost system

Q220: Gaters Incorporated makes a single product--an electrical

Q234: Dacker Products is a division of a

Q291: If net operating income is $70,000, average