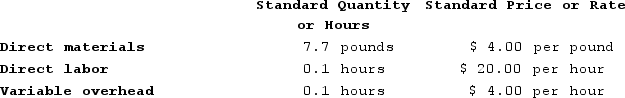

Milar Corporation makes a product with the following standard costs:  In January the company produced 2,000 units using 16,060 pounds of the direct material and 210 direct labor-hours. During the month, the company purchased 16,900 pounds of the direct material at a cost of $65,910. The actual direct labor cost was $4,473 and the actual variable overhead cost was $756.The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased.The labor rate variance for January is:

In January the company produced 2,000 units using 16,060 pounds of the direct material and 210 direct labor-hours. During the month, the company purchased 16,900 pounds of the direct material at a cost of $65,910. The actual direct labor cost was $4,473 and the actual variable overhead cost was $756.The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased.The labor rate variance for January is:

Definitions:

Parotid Swelling

An enlargement or inflammation of the parotid glands, typically indicative of an infection, blockage, or autoimmune disorder.

Constipation

A common condition characterized by difficulty in passing stool or infrequent bowel movements.

Hypotension

A condition where blood pressure is lower than the normal range, potentially leading to symptoms like dizziness or fainting.

Dental Caries

Tooth decay caused by bacterial infection, leading to cavities, pain, and tooth loss if untreated.

Q2: A nurse is administering I.V. potassium at

Q14: A nurse specialist is preparing to insert

Q14: A nurse is preparing to flush a

Q25: A physician orders 1,000 mL of 5%

Q52: Cabell Products is a division of a

Q133: Handerson Corporation makes a product with the

Q138: Fingado Products, Incorporated, has a Detector Division

Q175: Net operating income is income before interest

Q181: Doogan Corporation makes a product with the

Q196: Dirickson Incorporated has provided the following data