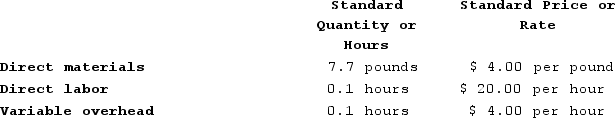

Milar Corporation makes a product with the following standard costs:  In January the company produced 2,000 units using 16,060 pounds of the direct material and 210 direct labor-hours. During the month, the company purchased 16,900 pounds of the direct material at a cost of $65,910. The actual direct labor cost was $4,473 and the actual variable overhead cost was $756.The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased.The variable overhead efficiency variance for January is:

In January the company produced 2,000 units using 16,060 pounds of the direct material and 210 direct labor-hours. During the month, the company purchased 16,900 pounds of the direct material at a cost of $65,910. The actual direct labor cost was $4,473 and the actual variable overhead cost was $756.The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased.The variable overhead efficiency variance for January is:

Definitions:

Equity Multiplier

A measure of a company's financial leverage, calculated by dividing its total assets by total stockholders' equity.

Net Income

The net income of a company once all costs and taxes are subtracted from the total earnings.

Total Assets Turnover

A financial ratio that measures a company's efficiency in using its assets to generate revenue.

Sales

Revenue generated from the sale of goods or services.

Q2: Wetherald Products, Incorporated, has a Pump Division

Q3: An oncologist orders an antineoplastic agent to

Q7: A new client, diagnosed with AIDS, is

Q18: A nurse assesses a client who is

Q30: A nurse has finished placing a 20-gauge

Q36: Robnett Corporation manufactures one product. It does

Q43: When Raw Materials, Work in Process, and

Q182: Gabbe Industries is a division of a

Q242: Termeer Incorporated has provided the following data

Q251: Division A makes a part with the