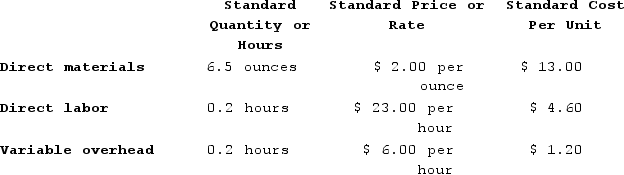

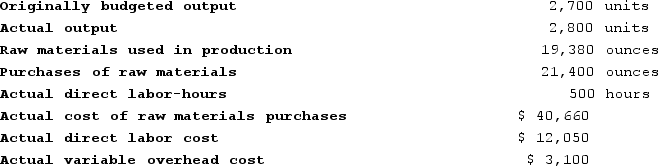

Tharaldson Corporation makes a product with the following standard costs:  The company reported the following results concerning this product in June.

The company reported the following results concerning this product in June. The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased.The materials price variance for June is:

The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased.The materials price variance for June is:

Definitions:

EBITDA Coverage Ratio

A financial ratio that measures a company's ability to pay off its operating expenses and debts with its EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization).

Debt Ratio

A financial ratio that compares a company’s total debt to its total assets, indicating the proportion of a company's assets that are financed by debt.

TIE Ratio

The times interest earned ratio, a financial metric measuring a company's ability to meet its debt obligations based on its current income.

Window Dress

Practices by mutual funds and other portfolio managers near the reporting period end to improve the appearance of the financial statements.

Q25: Zeilinger Products, Incorporated, has a Screen Division

Q32: The standard quantity or standard hours allowed

Q114: The following materials standards have been established

Q160: Fingado Products, Incorporated, has a Detector Division

Q178: The following data for November have been

Q258: Parsa Incorporated reported the following results from

Q321: The following data are for the Akron

Q371: Miguez Corporation makes a product with the

Q409: If the actual hourly rate is greater

Q446: The following data have been provided by