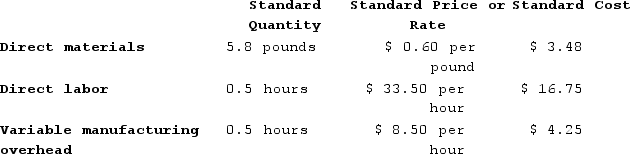

Puvo, Incorporated, manufactures a single product in which variable manufacturing overhead is assigned on the basis of standard direct labor-hours. The company uses a standard cost system and has established the following standards for one unit of product:  During March, the following activity was recorded by the company:The company produced 2,400 units during the month.A total of 19,400 pounds of material were purchased at a cost of $13,580.There was no beginning inventory of materials on hand to start the month; at the end of the month, 3,620 pounds of material remained in the warehouse.During March, 1,090 direct labor-hours were worked at a rate of $30.50 per hour.Variable manufacturing overhead costs during March totaled $14,061.The direct materials purchases variance is computed when the materials are purchased.The materials quantity variance for March is:

During March, the following activity was recorded by the company:The company produced 2,400 units during the month.A total of 19,400 pounds of material were purchased at a cost of $13,580.There was no beginning inventory of materials on hand to start the month; at the end of the month, 3,620 pounds of material remained in the warehouse.During March, 1,090 direct labor-hours were worked at a rate of $30.50 per hour.Variable manufacturing overhead costs during March totaled $14,061.The direct materials purchases variance is computed when the materials are purchased.The materials quantity variance for March is:

Definitions:

Trial Balance

A bookkeeping worksheet in which the balances of all ledgers are compiled into debit and credit columns to ensure a company's transactions are mathematically correct.

Debit Column

The left-hand column in an accounting journal or ledger where debits are recorded, indicating an increase in assets or expenses or a decrease in liabilities, equity, or income.

Credit Column

The section of a financial statement or ledger where increases in liabilities, equity, and revenue or decreases in assets and expenses are recorded.

Journalized Transactions

Recording financial transactions in a journal as part of the double-entry bookkeeping system.

Q1: A nurse administers a parenteral solution to

Q6: A nurse analyzes a client's laboratory report

Q13: A client has a triple-lumen tunneled

Q36: The character of each separately stated item

Q89: Herriot Corporation manufactures one product. It does

Q231: Alvino Corporation manufactures one product. It does

Q267: Parsa Incorporated reported the following results from

Q331: Babak Industries is a division of a

Q382: Lemke Corporation uses a standard cost system

Q387: The following labor standards have been established