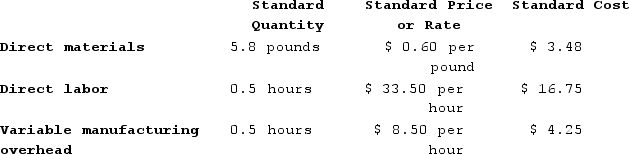

Puvo, Incorporated, manufactures a single product in which variable manufacturing overhead is assigned on the basis of standard direct labor-hours. The company uses a standard cost system and has established the following standards for one unit of product:  During March, the following activity was recorded by the company:The company produced 2,400 units during the month.A total of 19,400 pounds of material were purchased at a cost of $13,580.There was no beginning inventory of materials on hand to start the month; at the end of the month, 3,620 pounds of material remained in the warehouse.During March, 1,090 direct labor-hours were worked at a rate of $30.50 per hour.Variable manufacturing overhead costs during March totaled $14,061.The direct materials purchases variance is computed when the materials are purchased.The labor efficiency variance for March is:

During March, the following activity was recorded by the company:The company produced 2,400 units during the month.A total of 19,400 pounds of material were purchased at a cost of $13,580.There was no beginning inventory of materials on hand to start the month; at the end of the month, 3,620 pounds of material remained in the warehouse.During March, 1,090 direct labor-hours were worked at a rate of $30.50 per hour.Variable manufacturing overhead costs during March totaled $14,061.The direct materials purchases variance is computed when the materials are purchased.The labor efficiency variance for March is:

Definitions:

Producing

The act or process of creating goods or services by combining labor, materials, and technology.

Fifth Sweatshirt

Additional unit or item, indicative of a point in consumption where assessing marginal utility or other economic factors becomes relevant.

Ability-to-pay

A principle in taxation that states taxes should be levied on individuals or entities based on their ability to pay, which is often measured by income or wealth.

Higher Incomes

Refers to an increase in the amount of money earned by individuals or households, typically from employment, investments, or business operations.

Q10: A purchased partnership interest has a holding

Q16: A nurse is preparing to initiate I.V.

Q18: A nurse is caring for a client

Q57: Majer Corporation makes a product with the

Q128: Sue and Andrew form SA general partnership.

Q140: Pippin Incorporated has provided the following data

Q171: Zeilinger Products, Incorporated, has a Screen Division

Q195: Eastern Company uses a standard cost system

Q202: Mittan Products, Incorporated, has a Antennae Division

Q429: Rhudy Corporation uses a standard cost system