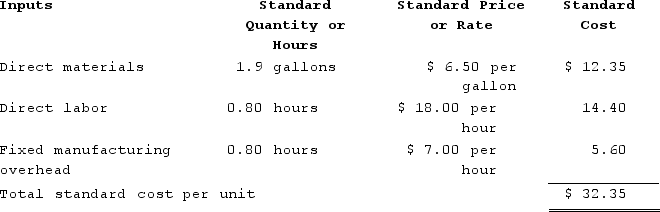

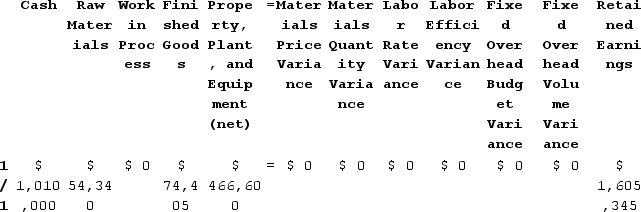

Ester Corporation manufactures one product. It does not maintain any beginning or ending Work in Process inventories. The company uses a standard cost system in which inventories are recorded at their standard costs. There is no variable manufacturing overhead. The standard cost card for the company's only product is as follows:  The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $168,000 and budgeted activity of 24,000 hours.During the year, the company applied fixed overhead to the 22,600 units in work in process inventory using the predetermined overhead rate multiplied by the number of direct labor-hours allowed. Actual fixed overhead costs for the year were $149,800. Of this total, $83,800 related to items such as insurance, utilities, and indirect labor salaries that were all paid in cash and $66,000 related to depreciation of manufacturing equipment.Assume that all transactions are recorded on the below worksheet, which is similar to the worksheet shown in your text except that it has been divided into two parts so that it fits on one page. The beginning balances in each of the accounts have been given. PP&E (net) stands for Property, Plant, and Equipment net of depreciation.

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $168,000 and budgeted activity of 24,000 hours.During the year, the company applied fixed overhead to the 22,600 units in work in process inventory using the predetermined overhead rate multiplied by the number of direct labor-hours allowed. Actual fixed overhead costs for the year were $149,800. Of this total, $83,800 related to items such as insurance, utilities, and indirect labor salaries that were all paid in cash and $66,000 related to depreciation of manufacturing equipment.Assume that all transactions are recorded on the below worksheet, which is similar to the worksheet shown in your text except that it has been divided into two parts so that it fits on one page. The beginning balances in each of the accounts have been given. PP&E (net) stands for Property, Plant, and Equipment net of depreciation. When applying fixed manufacturing overhead to production, the Work in Process inventory account will increase (decrease) by:

When applying fixed manufacturing overhead to production, the Work in Process inventory account will increase (decrease) by:

Definitions:

Logical Power

Logical power, often related to the concept of rational-legal authority, depends on an individual's ability to use logic and reason to persuade or influence others.

Coercive Power

A form of power that relies on the ability to punish or constrain others to comply with orders or requests.

Leader's Power

The capacity of a leader to influence, motivate, and enable others to contribute toward organizational success.

Merit Pay Raises

Salary increases awarded to employees based on their job performance, as a reward for their contributions to the organization's success.

Q4: Hardigree Corporation makes a product that has

Q18: A client is scheduled for surgical insertion

Q22: Gain and loss realized in a §351

Q110: Wadding Corporation applies manufacturing overhead to products

Q127: Does adjusting a partner's basis for tax-exempt

Q196: Dirickson Incorporated has provided the following data

Q282: Kita Corporation manufactures one product. It does

Q372: Freytag Corporation's variable overhead is applied on

Q399: Turrubiates Corporation makes a product that uses

Q434: The following data have been provided by