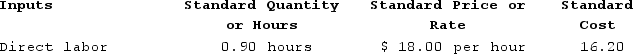

Decena Corporation manufactures one product. It does not maintain any beginning or ending Work in Process inventories. The company uses a standard cost system in which inventories are recorded at their standard costs. Information concerning the direct labor standards for the company's only product is as follows:  During the year, the company assigned direct labor costs to work in process. The direct labor workers (who were paid in cash) worked 15,830 hours at an average cost of $18.50 per hour. The company calculated the following direct labor variances for the year:

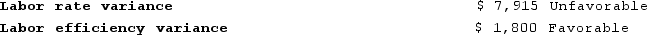

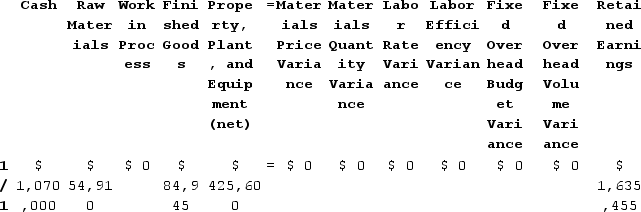

During the year, the company assigned direct labor costs to work in process. The direct labor workers (who were paid in cash) worked 15,830 hours at an average cost of $18.50 per hour. The company calculated the following direct labor variances for the year: Assume that all transactions are recorded on the below worksheet, which is similar to the worksheet shown in your text except that it has been divided into two parts so that it fits on one page. The beginning balances in each of the accounts have been given. PP&E (net) stands for Property, Plant, and Equipment net of depreciation.

Assume that all transactions are recorded on the below worksheet, which is similar to the worksheet shown in your text except that it has been divided into two parts so that it fits on one page. The beginning balances in each of the accounts have been given. PP&E (net) stands for Property, Plant, and Equipment net of depreciation. When recording the direct labor costs, the Work in Process inventory account will increase (decrease) by:

When recording the direct labor costs, the Work in Process inventory account will increase (decrease) by:

Definitions:

Price Ceiling

A government-imposed limit on how high a price can be charged for a product, intended to protect consumers from high prices.

Price Floor

A government- or authority-imposed minimum price that can be charged for a good or service, often above the equilibrium price.

Quantity Control

Regulatory or business practices that limit the production, sale, or distribution of products to influence market prices or quality.

Quota Rent

The earnings that accrue to the license-holder from owning the right to import a limited quantity of goods under a quota system.

Q1: A nurse assesses a newly admitted client

Q2: Frank and Bob are equal members in

Q3: A clinical nurse specialist is conducting an

Q6: If a partner participates in partnership activities

Q71: Majer Corporation makes a product with the

Q93: Stibbins Products, Incorporated, has a Receiver Division

Q123: Tom is talking to his friend Bob,

Q209: Polaco Corporation makes a product that has

Q232: The Consumer Products Division of Goich Corporation

Q420: The following labor standards have been established