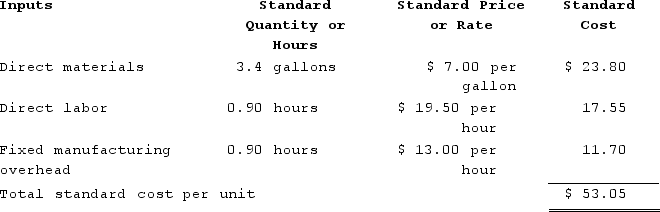

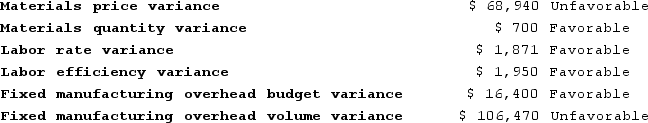

Jakeman Corporation manufactures one product. It does not maintain any beginning or ending Work in Process inventories. The company uses a standard cost system in which inventories are recorded at their standard costs and any variances are closed directly to Cost of Goods Sold. There is no variable manufacturing overhead.The standard cost card for the company's only product is as follows:  The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $351,000 and budgeted activity of 27,000 hours.During the year, the company completed the following transactions:Purchased 76,600 gallons of raw material at a price of $7.90 per gallon.Used 70,960 gallons of the raw material to produce 20,900 units of work in process.Assigned direct labor costs to work in process. The direct labor workers (who were paid in cash) worked 18,710 hours at an average cost of $19.40 per hour.Applied fixed overhead to the 20,900 units in work in process inventory using the predetermined overhead rate multiplied by the number of direct labor-hours allowed. Actual fixed overhead costs for the year were $334,600. Of this total, $252,600 related to items such as insurance, utilities, and indirect labor salaries that were all paid in cash and $82,000 related to depreciation of manufacturing equipment.Completed and transferred 20,900 units from work in process to finished goods.Sold (for cash) 17,700 units to customers at a price of $74.30 per unit.Transferred the standard cost associated with the 17,700 units sold from finished goods to cost of goods sold.Paid $93,000 of selling and administrative expenses.Closed all standard cost variances to cost of goods sold.The company calculated the following variances for the year:

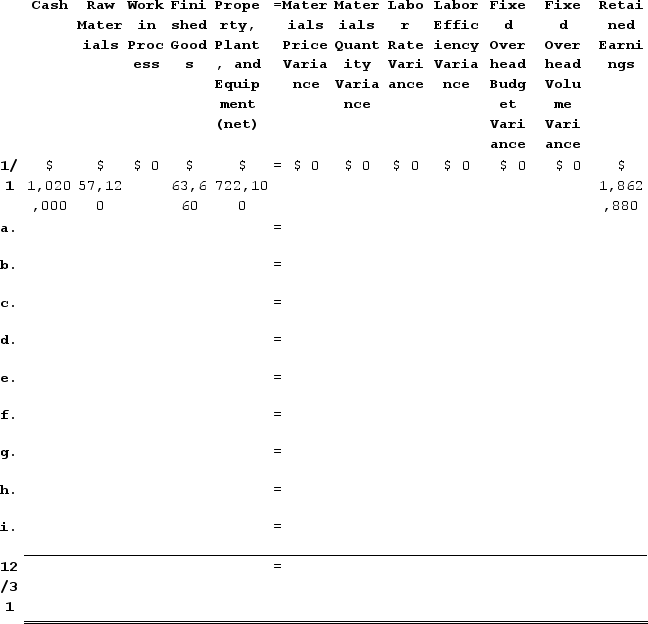

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $351,000 and budgeted activity of 27,000 hours.During the year, the company completed the following transactions:Purchased 76,600 gallons of raw material at a price of $7.90 per gallon.Used 70,960 gallons of the raw material to produce 20,900 units of work in process.Assigned direct labor costs to work in process. The direct labor workers (who were paid in cash) worked 18,710 hours at an average cost of $19.40 per hour.Applied fixed overhead to the 20,900 units in work in process inventory using the predetermined overhead rate multiplied by the number of direct labor-hours allowed. Actual fixed overhead costs for the year were $334,600. Of this total, $252,600 related to items such as insurance, utilities, and indirect labor salaries that were all paid in cash and $82,000 related to depreciation of manufacturing equipment.Completed and transferred 20,900 units from work in process to finished goods.Sold (for cash) 17,700 units to customers at a price of $74.30 per unit.Transferred the standard cost associated with the 17,700 units sold from finished goods to cost of goods sold.Paid $93,000 of selling and administrative expenses.Closed all standard cost variances to cost of goods sold.The company calculated the following variances for the year: To answer the following questions, it would be advisable to record transactions a through i in the worksheet below. This worksheet is similar to the worksheets in your text except that it has been split into two parts to fit on the page. PP&E (net) stands for Property, Plant, and Equipment net of depreciation.

To answer the following questions, it would be advisable to record transactions a through i in the worksheet below. This worksheet is similar to the worksheets in your text except that it has been split into two parts to fit on the page. PP&E (net) stands for Property, Plant, and Equipment net of depreciation. When the company closes its standard cost variances, the Cost of Goods Sold will increase (decrease) by:

When the company closes its standard cost variances, the Cost of Goods Sold will increase (decrease) by:

Definitions:

Compromise

A conflict management style in which each party to a conflict gives up something of value to the other.

Conflict Management

The practice of identifying and handling conflicts in a sensible, fair, and efficient manner, with the goal of reaching a resolution that suits all parties involved.

Bargaining

The negotiation process through which parties arrive at a mutual agreement on the terms of a transaction or deal.

Competition

A conflict management style in which the person uses force, superior skill, or domination to “win” a conflict.

Q9: A nurse educator is conducting an in-service

Q50: Which of the following does not adjust

Q73: Phann Corporation manufactures one product. It does

Q117: Levar Corporation has two operating divisions-a Consumer

Q127: Gretter Corporation has two operating divisions-an Atlantic

Q130: John, a limited partner of Candy Apple,

Q224: Division Y has asked Division X of

Q247: Levar Corporation has two operating divisions-a Consumer

Q319: The following standards for variable manufacturing overhead

Q398: Arena Corporation manufactures one product. It does