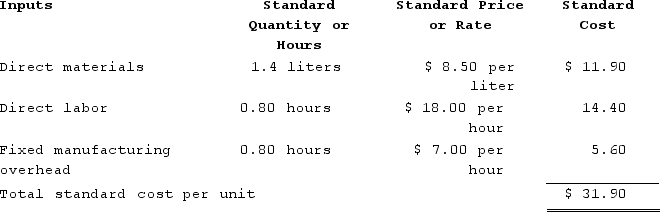

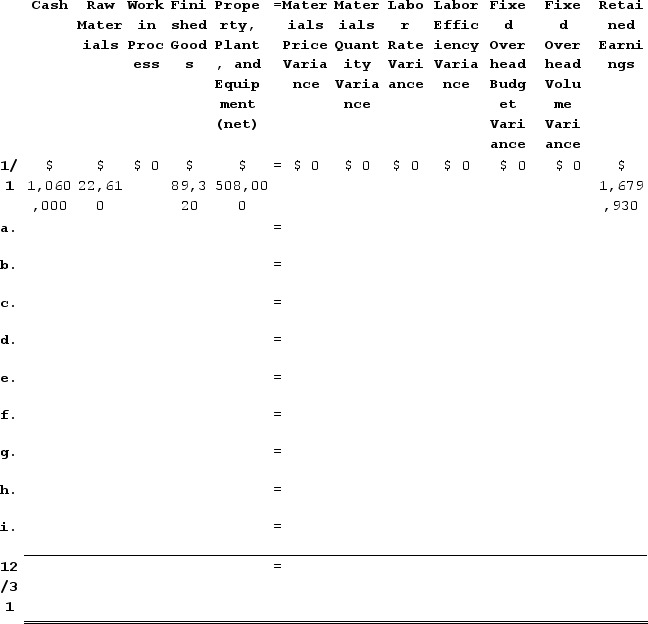

Samples Corporation manufactures one product. It does not maintain any beginning or ending Work in Process inventories. The company uses a standard cost system in which inventories are recorded at their standard costs and any variances are closed directly to Cost of Goods Sold. There is no variable manufacturing overhead. The standard cost card for the company's only product is as follows:  The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $140,000 and budgeted activity of 20,000 hours.During the year, the company completed the following transactions:Purchased 49,500 liters of raw material at a price of $8.00 per liter. The materials price variance was $24,750 Favorable.Used 45,820 liters of the raw material to produce 32,800 units of work in process. The materials quantity variance was $850 Favorable.Assigned direct labor costs to work in process. The direct labor workers (who were paid in cash) worked 28,440 hours at an average cost of $17.00 per hour. The direct labor rate variance was $28,440 Favorable. The labor efficiency variance was $39,600 Unfavorable.Applied fixed overhead to the 32,800 units in work in process inventory using the predetermined overhead rate multiplied by the number of direct labor-hours allowed. Actual fixed overhead costs for the year were $154,700. Of this total, $83,700 related to items such as insurance, utilities, and indirect labor salaries that were all paid in cash and $71,000 related to depreciation of manufacturing equipment. The fixed manufacturing overhead budget variance was $14,700 Unfavorable. The fixed manufacturing overhead volume variance was $43,680 Favorable.Completed and transferred 32,800 units from work in process to finished goods.Sold (for cash) 32,000 units to customers at a price of $38.20 per unit.Transferred the standard cost associated with the 32,000 units sold from finished goods to cost of goods sold.Paid $133,000 of selling and administrative expenses.Closed all standard cost variances to cost of goods sold.To answer the following questions, it would be advisable to record transactions a through i in the worksheet below. This worksheet is similar to the worksheets in your text except that it has been split into two parts to fit on the page. PP&E (net) stands for Property, Plant, and Equipment net of depreciation.

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $140,000 and budgeted activity of 20,000 hours.During the year, the company completed the following transactions:Purchased 49,500 liters of raw material at a price of $8.00 per liter. The materials price variance was $24,750 Favorable.Used 45,820 liters of the raw material to produce 32,800 units of work in process. The materials quantity variance was $850 Favorable.Assigned direct labor costs to work in process. The direct labor workers (who were paid in cash) worked 28,440 hours at an average cost of $17.00 per hour. The direct labor rate variance was $28,440 Favorable. The labor efficiency variance was $39,600 Unfavorable.Applied fixed overhead to the 32,800 units in work in process inventory using the predetermined overhead rate multiplied by the number of direct labor-hours allowed. Actual fixed overhead costs for the year were $154,700. Of this total, $83,700 related to items such as insurance, utilities, and indirect labor salaries that were all paid in cash and $71,000 related to depreciation of manufacturing equipment. The fixed manufacturing overhead budget variance was $14,700 Unfavorable. The fixed manufacturing overhead volume variance was $43,680 Favorable.Completed and transferred 32,800 units from work in process to finished goods.Sold (for cash) 32,000 units to customers at a price of $38.20 per unit.Transferred the standard cost associated with the 32,000 units sold from finished goods to cost of goods sold.Paid $133,000 of selling and administrative expenses.Closed all standard cost variances to cost of goods sold.To answer the following questions, it would be advisable to record transactions a through i in the worksheet below. This worksheet is similar to the worksheets in your text except that it has been split into two parts to fit on the page. PP&E (net) stands for Property, Plant, and Equipment net of depreciation. The net operating income for the year is closest to:

The net operating income for the year is closest to:

Definitions:

Cerebrum

The largest part of the brain, responsible for voluntary activities, sensory perception, thought, reasoning, and memory.

Caudate Nucleus

A structure within the brain involved in various processes such as voluntary movement coordination and learning.

Lateral Fissure

A deep groove on the surface of the brain separating the temporal lobe from the frontal and parietal lobes.

Cerebrum

The cerebrum is the largest part of the brain, responsible for cognitive functions such as thought, memory, and decision-making.

Q2: A trauma physician orders an intraosseous (IO)

Q12: Tim, a real estate investor, Ken, a

Q15: A nurse is caring for a hospitalized

Q20: Mccreary Corporation manufactures one product. It does

Q23: A client presents to an emergency department

Q130: Cominsky Products, Incorporated, has a Screen Division

Q212: At Eady Corporation, maintenance is a variable

Q279: The Maxit Corporation has a standard costing

Q300: Tommasino Products, Incorporated, has a Motor Division

Q440: Klacic Corporation makes a product with the