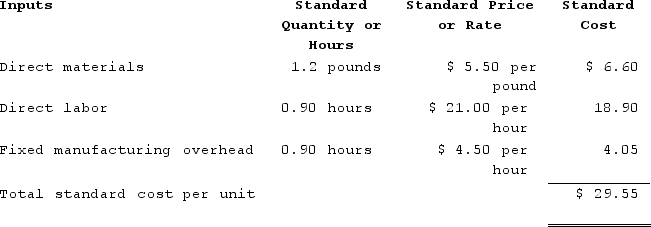

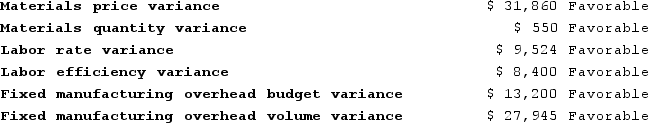

Arena Corporation manufactures one product. It does not maintain any beginning or ending Work in Process inventories. The company uses a standard cost system in which inventories are recorded at their standard costs and any variances are closed directly to Cost of Goods Sold. There is no variable manufacturing overhead.The standard cost card for the company's only product is as follows:  The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $81,000 and budgeted activity of 18,000 hours.During the year, the company completed the following transactions:Purchased 35,400 pounds of raw material at a price of $4.60 per pound.Used 32,180 pounds of the raw material to produce 26,900 units of work in process.Assigned direct labor costs to work in process. The direct labor workers (who were paid in cash) worked 23,810 hours at an average cost of $20.60 per hour.Applied fixed overhead to the 26,900 units in work in process inventory using the predetermined overhead rate multiplied by the number of direct labor-hours allowed. Actual fixed overhead costs for the year were $67,800. Of this total, $3,800 related to items such as insurance, utilities, and indirect labor salaries that were all paid in cash and $64,000 related to depreciation of manufacturing equipment.Completed and transferred 26,900 units from work in process to finished goods.Sold (for cash) 27,100 units to customers at a price of $36.60 per unit.Transferred the standard cost associated with the 27,100 units sold from finished goods to cost of goods sold.Paid $149,000 of selling and administrative expenses.Closed all standard cost variances to cost of goods sold.The company calculated the following variances for the year:

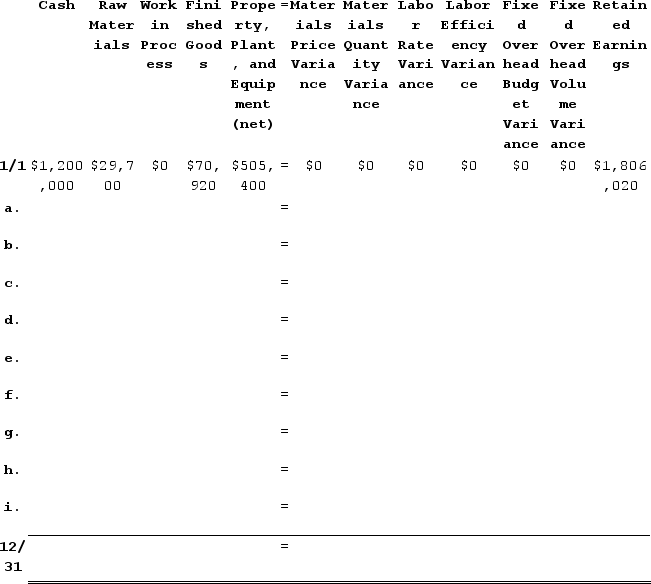

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $81,000 and budgeted activity of 18,000 hours.During the year, the company completed the following transactions:Purchased 35,400 pounds of raw material at a price of $4.60 per pound.Used 32,180 pounds of the raw material to produce 26,900 units of work in process.Assigned direct labor costs to work in process. The direct labor workers (who were paid in cash) worked 23,810 hours at an average cost of $20.60 per hour.Applied fixed overhead to the 26,900 units in work in process inventory using the predetermined overhead rate multiplied by the number of direct labor-hours allowed. Actual fixed overhead costs for the year were $67,800. Of this total, $3,800 related to items such as insurance, utilities, and indirect labor salaries that were all paid in cash and $64,000 related to depreciation of manufacturing equipment.Completed and transferred 26,900 units from work in process to finished goods.Sold (for cash) 27,100 units to customers at a price of $36.60 per unit.Transferred the standard cost associated with the 27,100 units sold from finished goods to cost of goods sold.Paid $149,000 of selling and administrative expenses.Closed all standard cost variances to cost of goods sold.The company calculated the following variances for the year: To answer the following questions, you will need to record transactions a through i in the worksheet below. This worksheet is similar to the worksheets in your text except that it has been split into two parts to fit on the page. PP&E (net) stands for Property, Plant, and Equipment net of depreciation.

To answer the following questions, you will need to record transactions a through i in the worksheet below. This worksheet is similar to the worksheets in your text except that it has been split into two parts to fit on the page. PP&E (net) stands for Property, Plant, and Equipment net of depreciation. The ending balance in the Property, Plant, and Equipment (net) account will be closest to:

The ending balance in the Property, Plant, and Equipment (net) account will be closest to:

Definitions:

Disrespected

Feeling undervalued, underestimated, or unfairly treated by others, often leading to feelings of injustice or anger.

Value Types

The different categories or kinds of values that people hold, which influence their attitudes, behaviors, and perceptions of the world.

Universal

Applicable everywhere or in all cases; general in nature.

Cultures

The sum of attitudes, customs, and beliefs that distinguishes one group of people from another, transmitted through languages, material objects, ritual, institutions, and art.

Q7: A nurse assesses the insertion site of

Q19: A nurse assesses a client who has

Q24: Jay has a tax basis of $20,000

Q25: A physician orders 1,000 mL of 5%

Q43: Ruby's tax basis in her partnership interest

Q51: Miguez Corporation makes a product with the

Q86: Bumgardner Incorporated has provided the following data

Q93: Casey transfers property with a tax basis

Q110: Continuity of interest as it relates to

Q120: The following standards have been established for