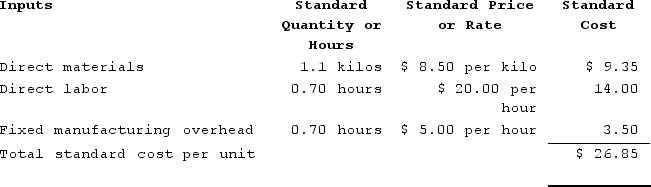

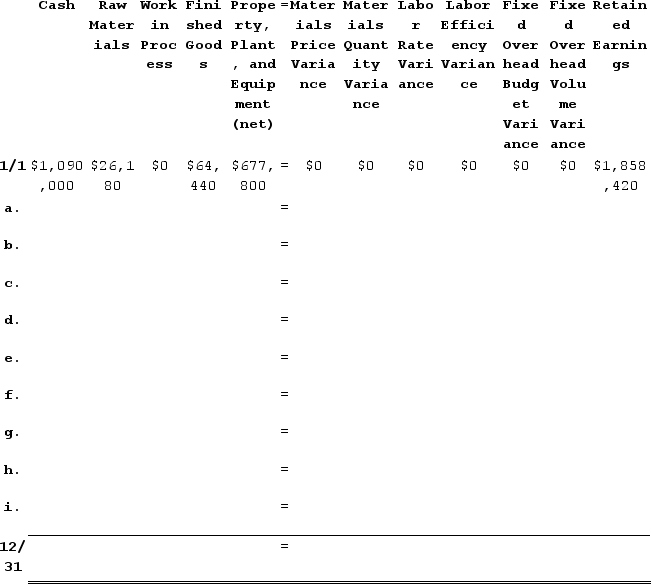

Alvino Corporation manufactures one product. It does not maintain any beginning or ending Work in Process inventories. The company uses a standard cost system in which inventories are recorded at their standard costs and any variances are closed directly to Cost of Goods Sold. There is no variable manufacturing overhead.The standard cost card for the company's only product is as follows:  The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $70,000 and budgeted activity of 14,000 hours.During the year, the company completed the following transactions:Purchased 32,200kilos of raw material at a price of $7.80 per kilo. The materials price variance was $22,540 Favorable.Used 30,480kilos of the raw material to produce 27,800 units of work in process. The materials quantity variance was $850 Favorable.Assigned direct labor costs to work in process. The direct labor workers (who were paid in cash) worked 18,260 hours at an average cost of $20.50 per hour. The direct labor rate variance was $9,130 Unfavorable. The labor efficiency variance was $24,000 Favorable.Applied fixed overhead to the 27,800 units in work in process inventory using the predetermined overhead rate multiplied by the number of direct labor−hours allowed. Actual fixed overhead costs for the year were $59,500. Of this total, $22,500 related to items such as insurance, utilities, and indirect labor salaries that were all paid in cash and $82,000 related to depreciation of manufacturing equipment. The fixed manufacturing overhead budget variance was $10,500 Favorable. The fixed manufacturing overhead volume variance was $27,300 Favorable.Completed and transferred 27,800 units from work in process to finished goods.Sold (for cash) 29,000 units to customers at a price of $31.90 per unit.Transferred the standard cost associated with the 29,000 units sold from finished goods to cost of goods sold.Paid $101,000 of selling and administrative expenses.Closed all standard cost variances to cost of goods sold.To answer the following questions, you will need to record transactions a through i in the worksheet below. This worksheet is similar to the worksheets in your text except that it has been split into two parts to fit on the page. PP&E (net) stands for Property, Plant, and Equipment net of depreciation.

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $70,000 and budgeted activity of 14,000 hours.During the year, the company completed the following transactions:Purchased 32,200kilos of raw material at a price of $7.80 per kilo. The materials price variance was $22,540 Favorable.Used 30,480kilos of the raw material to produce 27,800 units of work in process. The materials quantity variance was $850 Favorable.Assigned direct labor costs to work in process. The direct labor workers (who were paid in cash) worked 18,260 hours at an average cost of $20.50 per hour. The direct labor rate variance was $9,130 Unfavorable. The labor efficiency variance was $24,000 Favorable.Applied fixed overhead to the 27,800 units in work in process inventory using the predetermined overhead rate multiplied by the number of direct labor−hours allowed. Actual fixed overhead costs for the year were $59,500. Of this total, $22,500 related to items such as insurance, utilities, and indirect labor salaries that were all paid in cash and $82,000 related to depreciation of manufacturing equipment. The fixed manufacturing overhead budget variance was $10,500 Favorable. The fixed manufacturing overhead volume variance was $27,300 Favorable.Completed and transferred 27,800 units from work in process to finished goods.Sold (for cash) 29,000 units to customers at a price of $31.90 per unit.Transferred the standard cost associated with the 29,000 units sold from finished goods to cost of goods sold.Paid $101,000 of selling and administrative expenses.Closed all standard cost variances to cost of goods sold.To answer the following questions, you will need to record transactions a through i in the worksheet below. This worksheet is similar to the worksheets in your text except that it has been split into two parts to fit on the page. PP&E (net) stands for Property, Plant, and Equipment net of depreciation. The ending balance in the Retained Earnings account at the end of the year is closest to:

The ending balance in the Retained Earnings account at the end of the year is closest to:

Definitions:

Absorption Costing

A costing approach that encompasses all expenses related to production, including direct materials, direct labor, and all manufacturing overheads, both variable and fixed, as part of a product's cost.

Selling and Administrative Expenses

Expenses related to the selling of products and the management of the business, not directly tied to production.

Net Income

The total profit of a company after subtracting all expenses from revenue, including taxes and costs.

Units Sold

The total number of product units that have been sold during a particular time period.

Q2: A trauma physician orders an intraosseous (IO)

Q3: Upon inspection of a client's peripheral I.V.

Q19: Bohon Corporation manufactures one product. It does

Q27: A nurse assesses a newly admitted client

Q39: An additional allocation of partnership debt or

Q43: Roberta transfers property with a tax basis

Q54: Miguez Corporation makes a product with the

Q106: Fregozo Products, Incorporated, has a Connector Division

Q195: Eastern Company uses a standard cost system

Q249: The materials price variance is computed based