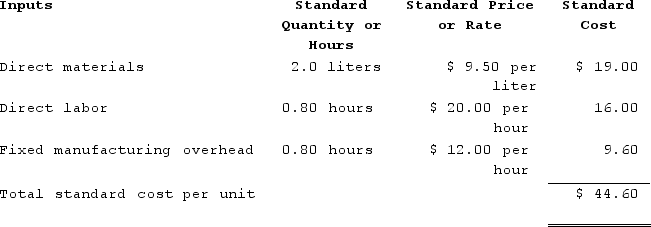

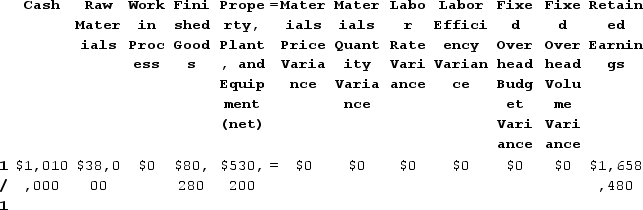

Alberts Corporation manufactures one product. It does not maintain any beginning or ending Work in Process inventories. The company uses a standard cost system in which inventories are recorded at their standard costs. The standard cost card for the company's only product is as follows:  The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $240,000 and budgeted activity of 20,000 hours.During the year, the company applied fixed overhead to the 15,200 units in work in process inventory using the predetermined overhead rate multiplied by the number of direct labor-hours allowed. Actual fixed overhead costs for the year were $223,700. Of this total, $147,700 related to items such as insurance, utilities, and indirect labor salaries that were all paid in cash and $76,000 related to depreciation of manufacturing equipment.Assume that all transactions are recorded on the below worksheet, which is similar to the worksheet shown in your text except that it has been divided into two parts so that it fits on one page. The beginning balances in each of the accounts have been given. PP&E (net) stands for Property, Plant, and Equipment net of depreciation.

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $240,000 and budgeted activity of 20,000 hours.During the year, the company applied fixed overhead to the 15,200 units in work in process inventory using the predetermined overhead rate multiplied by the number of direct labor-hours allowed. Actual fixed overhead costs for the year were $223,700. Of this total, $147,700 related to items such as insurance, utilities, and indirect labor salaries that were all paid in cash and $76,000 related to depreciation of manufacturing equipment.Assume that all transactions are recorded on the below worksheet, which is similar to the worksheet shown in your text except that it has been divided into two parts so that it fits on one page. The beginning balances in each of the accounts have been given. PP&E (net) stands for Property, Plant, and Equipment net of depreciation. When the fixed manufacturing overhead cost is recorded, which of the following entries will be made?

When the fixed manufacturing overhead cost is recorded, which of the following entries will be made?

Definitions:

Weight-loss Supplements

Products intended to aid in weight loss by reducing appetite, increasing metabolism, or blocking fat absorption.

Successful Weight Loss

Achieving and maintaining a healthier weight through diet, exercise, and lifestyle changes.

Hypertension

A medical condition characterized by high blood pressure in the arteries, posing significant health risks.

Nutrition Plan

A structured guideline detailing what and when a person should eat to achieve specific health or fitness goals.

Q14: A nursing instructor is teaching a group

Q51: Miguez Corporation makes a product with the

Q58: Under general circumstances, debt is allocated from

Q118: Gipple Corporation makes a product that uses

Q205: The following labor standards have been established

Q215: Ranallo Incorporated reported the following results from

Q356: Kartman Corporation makes a product with the

Q383: Creger Corporation, which makes landing gears, has

Q389: Ravena Labs., Incorporated makes a single product

Q396: Canel Incorporated makes a single product--an electrical