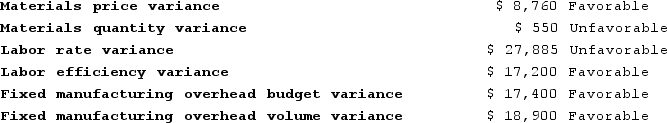

Woodhead Incorporated manufactures one product. It does not maintain any beginning or ending inventories. The company uses a standard cost system in which inventories are recorded at their standard costs and any variances are closed directly to Cost of Goods Sold. Its standard cost per unit produced is $37.45. During the year, the company produced and sold 24,400 units at a price of $47.40 per unit and its selling and administrative expenses totaled $92,000. The company does not have any variable manufacturing overhead costs. It recorded the following variances during the year:  The net operating income for the year is closest to:

The net operating income for the year is closest to:

Definitions:

Divorce Agreement

A divorce agreement is a legally binding document outlining the division of assets, debts, and other obligations between spouses upon the dissolution of their marriage.

Above-the-line Deduction

Deductions from gross income that are made before the calculation of taxable income, directly reducing the gross income amount.

AGI Deduction

Deductions that can be taken from gross income to arrive at the Adjusted Gross Income, which is used as a basis for calculating taxable income.

Art Supplies

Materials and tools used in the creation of artwork, the costs of which may be tax-deductible for professional artists or educators under certain conditions.

Q6: Which of the following statements does not

Q8: A client with pancreatitis has an order

Q18: Ferrero Corporation manufactures one product. It does

Q25: Irving Corporation makes a product with the

Q46: A liquidated corporation will always recognize loss

Q95: Amy transfers property with a tax basis

Q131: The following labor standards have been established

Q133: The Downstate Block Company has a trucking

Q202: Kartman Corporation makes a product with the

Q296: Jakeman Corporation manufactures one product. It does