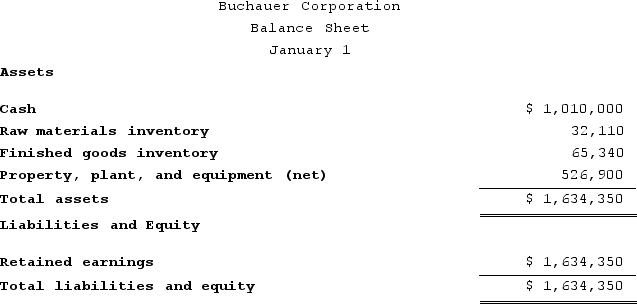

Buchauer Corporation manufactures one product. It does not maintain any beginning or ending Work in Process inventories. The company uses a standard cost system in which inventories are recorded at their standard costs and any variances are closed directly to Cost of Goods Sold. There is no variable manufacturing overhead. The company's balance sheet at the beginning of the year was as follows:

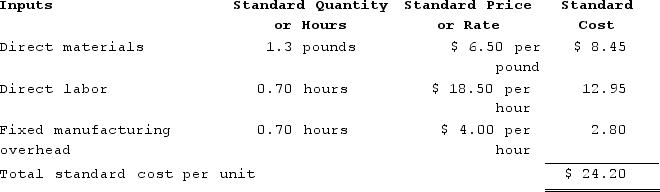

The standard cost card for the company's only product is as follows:

The standard cost card for the company's only product is as follows:

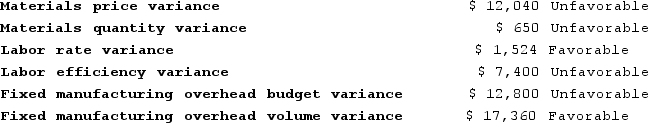

The company calculated the following variances for the year:

The company calculated the following variances for the year:

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $42,000 and budgeted activity of 10,500 hours.

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $42,000 and budgeted activity of 10,500 hours.

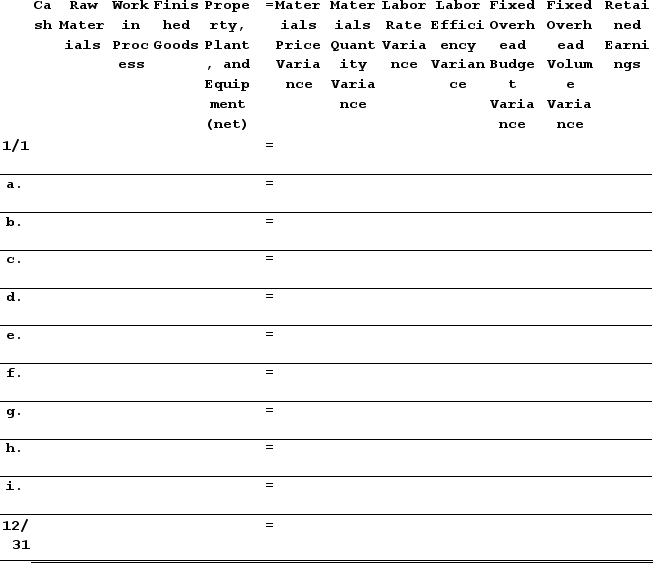

During the year, the company completed the following transactions:

a. Purchased 30,100 pounds of raw material at a price of $6.90 per pound.b. Used 27,660 pounds of the raw material to produce 21,200 units of work in process.c. Assigned direct labor costs to work in process. The direct labor workers (who were paid in cash) worked 15,240 hours at an average cost of $18.40 per hour.d. Applied fixed overhead to the 21,200 units in work in process inventory using the predetermined overhead rate multiplied by the number of direct labor-hours allowed. Actual fixed overhead costs for the year were $54,800. Of this total, -$10,200 related to items such as insurance, utilities, and indirect labor salaries that were all paid in cash and $65,000 related to depreciation of manufacturing equipment.e. Transferred 21,200 units from work in process to finished goods.f. Sold for cash 22,800 units to customers at a price of $29.70 per unit.g. Completed and transferred the standard cost associated with the 22,800 units sold from finished goods to cost of goods sold.h. Paid $74,000 of selling and administrative expenses.i. Closed all standard cost variances to cost of goods sold.

Required:1. Enter the beginning balances and record the above transactions in the worksheet that appears below.

2.Determine the ending balance (e.g., 12/31 balance) in each account.3. Prepare an income statement for the year.

2.Determine the ending balance (e.g., 12/31 balance) in each account.3. Prepare an income statement for the year.

Definitions:

Costing

The process of determining or calculating the total cost involved in making a product or providing a service.

Training Program

A structured and systematic plan of activities designed to enhance the knowledge, skills, and competencies of participants for professional or personal development.

Cost Groupings

The classification of costs into categories, often for accounting, reporting, or analysis purposes.

Cost-Effectiveness

A measure evaluating the relative expense of an intervention or action in generating a desired outcome or benefit, typically considering the most efficient use of resources.

Q11: A home-care nurse provides education regarding basic

Q15: A nurse using a pair of scissors

Q28: Kita Corporation manufactures one product. It does

Q70: A stock redemption is always treated as

Q70: Milanese Corporation manufactures one product. It does

Q72: Bulluck Corporation makes a product with the

Q137: Krizun Industries makes heavy construction equipment. The

Q184: Pearlman Incorporated makes a single product--an electrical

Q260: Magno Cereal Corporation uses a standard cost

Q310: Moozi Dairy Products processes and sells two