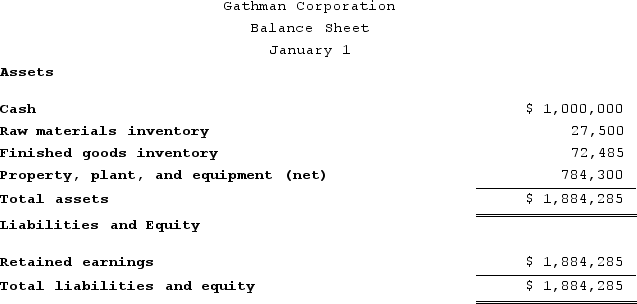

Gathman Corporation manufactures one product. It does not maintain any beginning or ending Work in Process inventories. The company uses a standard cost system in which inventories are recorded at their standard costs and any variances are closed directly to Cost of Goods Sold. There is no variable manufacturing overhead. The company's balance sheet at the beginning of the year was as follows:

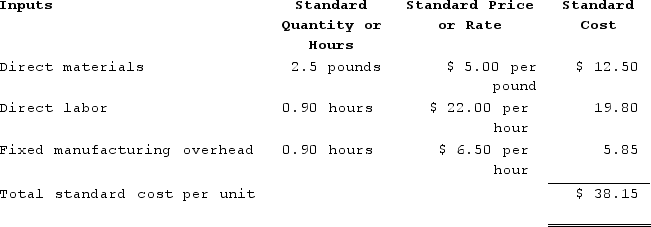

The standard cost card for the company's only product is as follows:

The standard cost card for the company's only product is as follows:

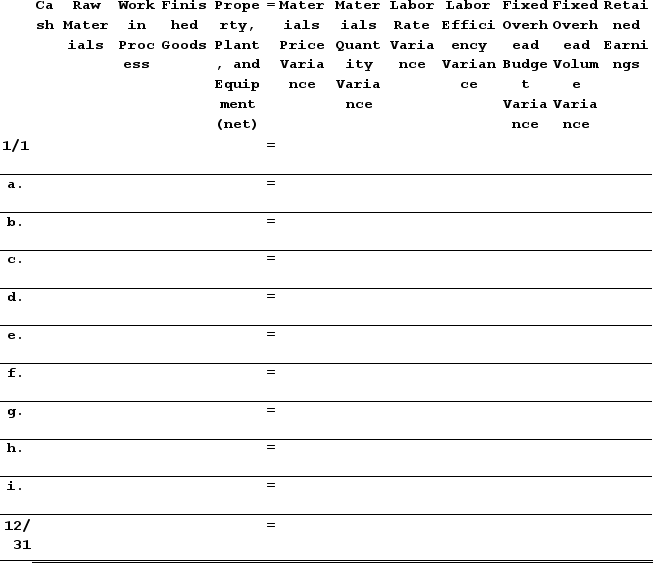

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $117,000 and budgeted activity of 18,000 hours.During the year, the company completed the following transactions:Purchased 36,300 pounds of raw material at a price of $4.70 per pound.Used 32,100 pounds of the raw material to produce 12,800 units of work in process.Assigned direct labor costs to work in process. The direct labor workers (who were paid in cash) worked 12,520 hours at an average cost of $21.00 per hour.Applied fixed overhead to the 12,800 units in work in process inventory using the predetermined overhead rate multiplied by the number of direct labor-hours allowed. Actual fixed overhead costs for the year were $132,700. Of this total, $27,700 related to items such as insurance, utilities, and indirect labor salaries that were all paid in cash and $105,000 related to depreciation of manufacturing equipment.Transferred 12,800 units from work in process to finished goods.Sold for cash 12,600 units to customers at a price of $52.10 per unit.Completed and transferred the standard cost associated with the 12,600 units sold from finished goods to cost of goods sold.Paid $73,000 of selling and administrative expenses.Closed all standard cost variances to cost of goods sold.Required:1. Compute all direct materials, direct labor, and fixed overhead variances for the year.2. Enter the beginning balances and record the above transactions in the worksheet that appears below. Because of the width of the worksheet, it is in two parts. In your text, these two parts would be joined side-by-side to make one very wide worksheet.

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $117,000 and budgeted activity of 18,000 hours.During the year, the company completed the following transactions:Purchased 36,300 pounds of raw material at a price of $4.70 per pound.Used 32,100 pounds of the raw material to produce 12,800 units of work in process.Assigned direct labor costs to work in process. The direct labor workers (who were paid in cash) worked 12,520 hours at an average cost of $21.00 per hour.Applied fixed overhead to the 12,800 units in work in process inventory using the predetermined overhead rate multiplied by the number of direct labor-hours allowed. Actual fixed overhead costs for the year were $132,700. Of this total, $27,700 related to items such as insurance, utilities, and indirect labor salaries that were all paid in cash and $105,000 related to depreciation of manufacturing equipment.Transferred 12,800 units from work in process to finished goods.Sold for cash 12,600 units to customers at a price of $52.10 per unit.Completed and transferred the standard cost associated with the 12,600 units sold from finished goods to cost of goods sold.Paid $73,000 of selling and administrative expenses.Closed all standard cost variances to cost of goods sold.Required:1. Compute all direct materials, direct labor, and fixed overhead variances for the year.2. Enter the beginning balances and record the above transactions in the worksheet that appears below. Because of the width of the worksheet, it is in two parts. In your text, these two parts would be joined side-by-side to make one very wide worksheet.

3. Determine the ending balance (e.g., 12/31 balance) in each account.4. Prepare an income statement for the year.

3. Determine the ending balance (e.g., 12/31 balance) in each account.4. Prepare an income statement for the year.

Definitions:

Stock Certificates

Physical documents that represent ownership in a company, indicating the number of shares held.

Ownership

The legal right or title to possess and use property, either tangible or intangible, with the freedom to control, enjoy, and dispose of it.

Articles Of Incorporation

A document that contains basic information about a corporation and is filed with the state.

Stock Subscriptions

Agreements to purchase shares in a company, often before they are available to the public.

Q9: Gerald received a one-third capital and profit

Q12: Brummer Corporation makes a product whose variable

Q27: XYZ, LLC, has several individual and corporate

Q32: The standard quantity or standard hours allowed

Q38: Lank Products, Incorporated, has a Transmitter Division

Q87: Bulluck Corporation makes a product with the

Q166: If demand is insufficient to keep everyone

Q242: Termeer Incorporated has provided the following data

Q316: Handerson Corporation makes a product with the

Q446: The following data have been provided by