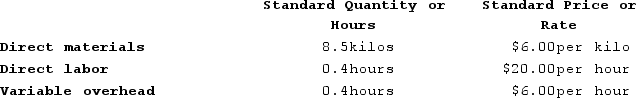

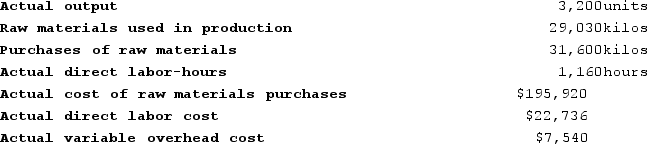

Handerson Corporation makes a product with the following standard costs:  The company reported the following results concerning this product in August.

The company reported the following results concerning this product in August. The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased.The variable overhead rate variance for August is:

The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased.The variable overhead rate variance for August is:

Definitions:

FIFO Method

The FIFO (First-In, First-Out) method is an inventory valuation strategy where the costs of the oldest inventory items are assigned to the cost of goods sold first.

Inventory Item

An item stored within a company's inventory that is ready or will be ready for sale, including raw materials, work-in-progress, and finished goods.

Gross Profit Method

A technique used in accounting to estimate the amount of ending inventory and cost of goods sold by applying a gross profit margin to sales.

Ending Inventory

The value of goods available for sale at the end of an accounting period, calculated as the beginning inventory plus purchases minus cost of goods sold.

Q3: A nurse notes that a client admitted

Q11: A physician orders 0.45% sodium chloride to

Q75: Corporate social responsibility performance reports are also

Q83: Division P of the Nyers Company makes

Q131: For performance evaluation purposes, the actual fixed

Q176: Godina Products, Incorporated, has a Receiver Division

Q192: Doogan Corporation makes a product with the

Q260: Sauseda Corporation has two operating divisions-an Inland

Q330: Stokan Products, Incorporated, has a Antennae Division

Q443: Piper Corporation's standards call for 1,000 direct