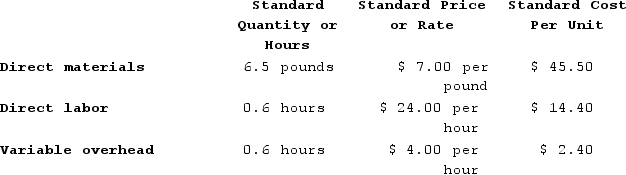

Kartman Corporation makes a product with the following standard costs:  In June the company's budgeted production was 3,400 units but the actual production was 3,500 units. The company used 22,150 pounds of the direct material and 2,290 direct labor-hours to produce this output. During the month, the company purchased 25,400 pounds of the direct material at a cost of $170,180. The actual direct labor cost was $57,021 and the actual variable overhead cost was $8,931.The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased.The variable overhead rate variance for June is:

In June the company's budgeted production was 3,400 units but the actual production was 3,500 units. The company used 22,150 pounds of the direct material and 2,290 direct labor-hours to produce this output. During the month, the company purchased 25,400 pounds of the direct material at a cost of $170,180. The actual direct labor cost was $57,021 and the actual variable overhead cost was $8,931.The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased.The variable overhead rate variance for June is:

Definitions:

Items

Refers to individual products or services that a company sells or the individual entries that make up a list or collection.

Intangible Assets

Non-physical assets owned by a business, such as patents, trademarks, goodwill, and copyrights, that have economic value and can provide future benefits.

Amortized

The gradual reduction of a debt or the spreading of capital expenses over a period of time.

Research and Development Costs

Expenses associated with the research and development of a company's goods or services, aiming to improve and innovate.

Q2: Wetherald Products, Incorporated, has a Pump Division

Q15: Zaino Corporation manufactures one product. It does

Q81: Division A of Tripper Company produces a

Q89: Wengert Products, Incorporated, has a Motor Division

Q181: Babak Industries is a division of a

Q186: Lido Company's standard and actual costs per

Q314: Financial data for Beaker Company for last

Q324: Leete Incorporated reported the following results from

Q325: Tommasino Products, Incorporated, has a Motor Division

Q372: Freytag Corporation's variable overhead is applied on