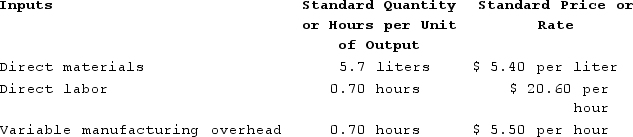

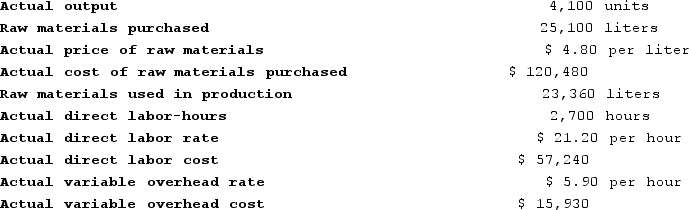

Fluegge Incorporated has provided the following data concerning one of the products in its standard cost system. Variable manufacturing overhead is applied to products on the basis of direct labor-hours.  The company has reported the following actual results for the product for December:

The company has reported the following actual results for the product for December: The raw materials price variance for the month is closest to:

The raw materials price variance for the month is closest to:

Definitions:

FIFO

FIFO, or First-In, First-Out, is an inventory valuation method where goods first added to inventory are the first to be sold.

IFRS

International Financial Reporting Standards, a set of accounting standards that provide a global framework for how public companies prepare and disclose their financial statements.

Net Realizable Value

The estimated selling price in the ordinary course of business minus any costs necessary to make the sale.

LIFO

Last In, First Out, an inventory valuation method where the last items added to inventory are assumed to be the first ones removed, affecting cost of goods sold and inventory value.

Q3: Which statements should a nurse include when

Q9: A nurse educator is conducting an in-service

Q13: Leonesio Corporation makes a product that uses

Q14: A nursing instructor is teaching a group

Q17: A nurse is caring for a client

Q30: A nurse has finished placing a 20-gauge

Q124: Freiling Corporation manufactures one product. It does

Q277: Kropf Incorporated has provided the following data

Q298: Puvo, Incorporated, manufactures a single product in

Q413: Miguez Corporation makes a product with the