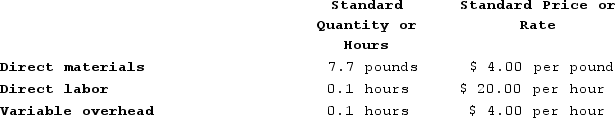

Milar Corporation makes a product with the following standard costs:  In January the company produced 2,000 units using 16,060 pounds of the direct material and 210 direct labor-hours. During the month, the company purchased 16,900 pounds of the direct material at a cost of $65,910. The actual direct labor cost was $4,473 and the actual variable overhead cost was $756.The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased.The materials quantity variance for January is:

In January the company produced 2,000 units using 16,060 pounds of the direct material and 210 direct labor-hours. During the month, the company purchased 16,900 pounds of the direct material at a cost of $65,910. The actual direct labor cost was $4,473 and the actual variable overhead cost was $756.The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased.The materials quantity variance for January is:

Definitions:

Ceramic Tile

A durable, hard surface tile made from clay that has been fired at high temperatures, used for covering floors, walls, or other surfaces.

Administrative Expense

Expenses related to the general operation of a business, including executive salaries, legal and professional fees, and office supplies.

Variable Cost

Costs that fluctuate in direct proportion to changes in levels of output or activity within a business.

Fixed Cost

Expenses that do not change in total over a certain range of activity levels or time periods, such as rent, salaries, and equipment leases.

Q9: Division C makes a part that it

Q15: A pediatric nurse is thinking critically to

Q22: Using the formula in the text, if

Q82: Phann Corporation manufactures one product. It does

Q143: Birkland Incorporated makes a single product--a critical

Q143: Given the following data: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8314/.jpg" alt="Given

Q190: Residual income is the difference between net

Q256: Boespflug Incorporated has a $1,000,000 investment opportunity

Q305: Selma Incorporated reported the following results from

Q388: Rhine Incorporated makes a single product--a critical