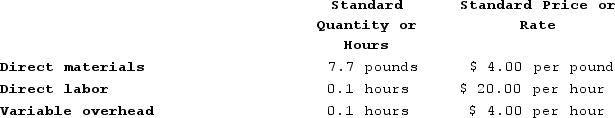

Milar Corporation makes a product with the following standard costs:  In January the company produced 2,000 units using 16,060 pounds of the direct material and 210 direct labor-hours. During the month, the company purchased 16,900 pounds of the direct material at a cost of $65,910. The actual direct labor cost was $4,473 and the actual variable overhead cost was $756.The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased.The variable overhead rate variance for January is:

In January the company produced 2,000 units using 16,060 pounds of the direct material and 210 direct labor-hours. During the month, the company purchased 16,900 pounds of the direct material at a cost of $65,910. The actual direct labor cost was $4,473 and the actual variable overhead cost was $756.The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased.The variable overhead rate variance for January is:

Definitions:

Variable Overhead Efficiency

The variance indicating the efficiency with which a variable overhead cost is incurred in relation to an activity level, such as machine or labor hours.

Rate Variance

The difference between the actual rate paid for an item or service and the expected (standard) rate, used in budgeting and cost control.

Budget Variance

A measurement of the difference between the budgeted or planned amount of expense or revenue, and the actual amount incurred/sold.

Predetermined Overhead Rate

An estimated charge used to distribute overhead costs to products or projects, based on an expected standard, allowing for cost allocation before actual expenses are known.

Q5: A nurse is caring for an elderly,

Q9: Division C makes a part that it

Q25: Irving Corporation makes a product with the

Q96: Cabell Products is a division of a

Q189: Milar Corporation makes a product with the

Q201: The Hum Division of the Ho Company

Q226: Ravena Labs., Incorporated makes a single product

Q295: The following data have been provided by

Q379: Bumgardner Incorporated has provided the following data

Q442: Arena Corporation manufactures one product. It does