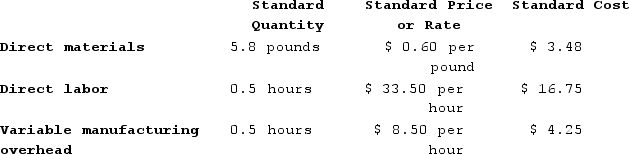

Puvo, Incorporated, manufactures a single product in which variable manufacturing overhead is assigned on the basis of standard direct labor-hours. The company uses a standard cost system and has established the following standards for one unit of product:  During March, the following activity was recorded by the company:The company produced 2,400 units during the month.A total of 19,400 pounds of material were purchased at a cost of $13,580.There was no beginning inventory of materials on hand to start the month; at the end of the month, 3,620 pounds of material remained in the warehouse.During March, 1,090 direct labor-hours were worked at a rate of $30.50 per hour.Variable manufacturing overhead costs during March totaled $14,061.The direct materials purchases variance is computed when the materials are purchased.The labor efficiency variance for March is:

During March, the following activity was recorded by the company:The company produced 2,400 units during the month.A total of 19,400 pounds of material were purchased at a cost of $13,580.There was no beginning inventory of materials on hand to start the month; at the end of the month, 3,620 pounds of material remained in the warehouse.During March, 1,090 direct labor-hours were worked at a rate of $30.50 per hour.Variable manufacturing overhead costs during March totaled $14,061.The direct materials purchases variance is computed when the materials are purchased.The labor efficiency variance for March is:

Definitions:

GAAP Warranty Expenses

Expenses recognized in accordance with Generally Accepted Accounting Principles (GAAP) related to the estimated cost of warranties on sold products.

Permanent Tax Difference

A discrepancy between taxable income and accounting income that will not reverse over time, affecting the tax and financial statements differently.

Taxable Income

The amount of income used to determine how much tax an individual or a company owes to the government in a given tax year.

Adjusted Pre-tax Book Income

Income calculated by making certain adjustments to the pre-tax income reported in the financial statements, often for tax or analytical purposes.

Q5: Actual or deemed cash distributions in excess

Q8: A client with active tuberculosis (TB) is

Q23: A nurse is applying a transparent, semipermeable

Q159: The Bowden Corporation makes a single product.

Q160: Chhom Corporation makes a product whose direct

Q212: Two of the decentralized divisions of Gamberi

Q239: Descamps Incorporated has provided the following data

Q263: If net operating income is $39,000, average

Q317: Bonilla Incorporated has a $700,000 investment opportunity

Q431: Hermansen Corporation produces large commercial doors for