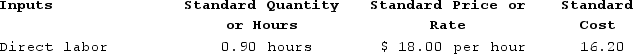

Decena Corporation manufactures one product. It does not maintain any beginning or ending Work in Process inventories. The company uses a standard cost system in which inventories are recorded at their standard costs. Information concerning the direct labor standards for the company's only product is as follows:  During the year, the company assigned direct labor costs to work in process. The direct labor workers (who were paid in cash) worked 15,830 hours at an average cost of $18.50 per hour. The company calculated the following direct labor variances for the year:

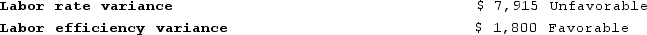

During the year, the company assigned direct labor costs to work in process. The direct labor workers (who were paid in cash) worked 15,830 hours at an average cost of $18.50 per hour. The company calculated the following direct labor variances for the year: Assume that all transactions are recorded on the below worksheet, which is similar to the worksheet shown in your text except that it has been divided into two parts so that it fits on one page. The beginning balances in each of the accounts have been given. PP&E (net) stands for Property, Plant, and Equipment net of depreciation.

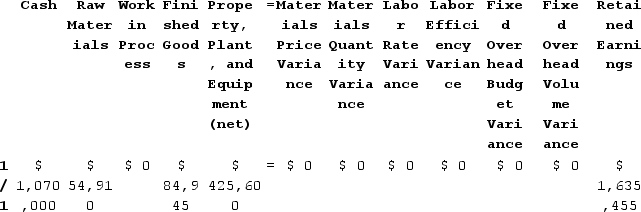

Assume that all transactions are recorded on the below worksheet, which is similar to the worksheet shown in your text except that it has been divided into two parts so that it fits on one page. The beginning balances in each of the accounts have been given. PP&E (net) stands for Property, Plant, and Equipment net of depreciation. When the direct labor cost is recorded, which of the following entries will be made?

When the direct labor cost is recorded, which of the following entries will be made?

Definitions:

Management By Exception

A management strategy where leaders only intervene when performance deviates from standards, allowing employees to work autonomously otherwise.

Charismatic Leaders

Individuals who possess a magnetic personality and the ability to inspire and motivate others through their vision, communication skills, and personal charisma.

Self-esteem Followers

Individuals who follow others based on a need for approval and validation to boost their own self-esteem.

LMX

Leader-Member Exchange, a theory that focuses on the relationships between leaders and individual team members.

Q16: Gauani Products, Incorporated, has a Detector Division

Q26: Sarah, Sue, and AS Incorporated formed a

Q47: Oaks Company maintains a cafeteria for its

Q49: Grub Chemical Corporation has developed cost standards

Q257: Wetherald Products, Incorporated, has a Pump Division

Q268: Fabbri Wares is a division of a

Q322: The West Division of Cecchetti Corporation had

Q341: Jakeman Corporation manufactures one product. It does

Q373: Milar Corporation makes a product with the

Q402: Hykes Corporation's manufacturing overhead includes $5.10 per