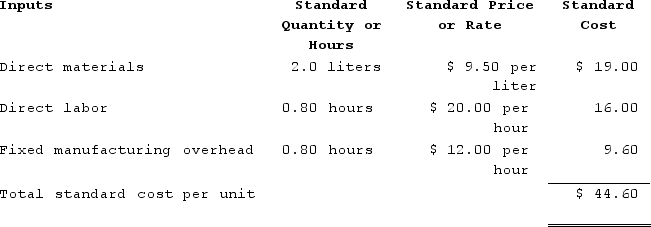

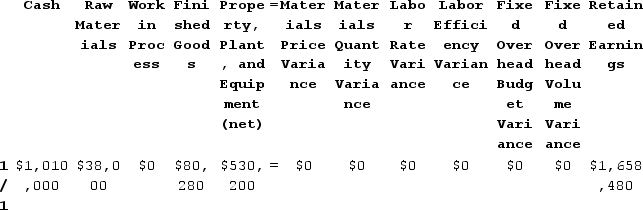

Alberts Corporation manufactures one product. It does not maintain any beginning or ending Work in Process inventories. The company uses a standard cost system in which inventories are recorded at their standard costs. The standard cost card for the company's only product is as follows:  The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $240,000 and budgeted activity of 20,000 hours.During the year, the company applied fixed overhead to the 15,200 units in work in process inventory using the predetermined overhead rate multiplied by the number of direct labor-hours allowed. Actual fixed overhead costs for the year were $223,700. Of this total, $147,700 related to items such as insurance, utilities, and indirect labor salaries that were all paid in cash and $76,000 related to depreciation of manufacturing equipment.Assume that all transactions are recorded on the below worksheet, which is similar to the worksheet shown in your text except that it has been divided into two parts so that it fits on one page. The beginning balances in each of the accounts have been given. PP&E (net) stands for Property, Plant, and Equipment net of depreciation.

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $240,000 and budgeted activity of 20,000 hours.During the year, the company applied fixed overhead to the 15,200 units in work in process inventory using the predetermined overhead rate multiplied by the number of direct labor-hours allowed. Actual fixed overhead costs for the year were $223,700. Of this total, $147,700 related to items such as insurance, utilities, and indirect labor salaries that were all paid in cash and $76,000 related to depreciation of manufacturing equipment.Assume that all transactions are recorded on the below worksheet, which is similar to the worksheet shown in your text except that it has been divided into two parts so that it fits on one page. The beginning balances in each of the accounts have been given. PP&E (net) stands for Property, Plant, and Equipment net of depreciation. When applying fixed manufacturing overhead to production, the Work in Process inventory account will increase (decrease) by:

When applying fixed manufacturing overhead to production, the Work in Process inventory account will increase (decrease) by:

Definitions:

Federal Unemployment Taxes

Taxes paid by employers to fund the federal government's oversight of the state's unemployment compensation programs.

Withhold

To deduct or hold back a portion of something, such as taxes from a paycheck.

Take-Home Pay

The net amount of income an employee actually receives after deductions such as taxes and retirement contributions.

Voluntary Deductions

Deductions from an employee's paycheck that the employee chooses to have withheld for benefits such as retirement plans, health insurance, and union dues.

Q11: A nurse prepares to assess a client

Q14: A nurse prepares to hang an infusion

Q24: Jay has a tax basis of $20,000

Q46: A liquidated corporation will always recognize loss

Q76: The variable overhead efficiency variance measures the

Q89: Partnership tax rules incorporate both the entity

Q161: Sobus Corporation manufactures one product. It does

Q212: Two of the decentralized divisions of Gamberi

Q386: Lacrue Incorporated has provided the following data

Q426: Lusher Corporation manufactures one product. It does