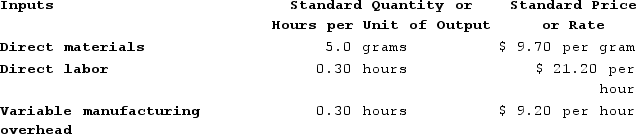

Mirabito Incorporated has provided the following data concerning one of the products in its standard cost system. Variable manufacturing overhead is applied to products on the basis of direct labor-hours.

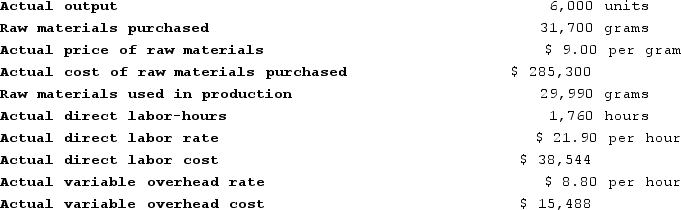

The company has reported the following actual results for the product for December:

The company has reported the following actual results for the product for December:

Required:

Required:

a. Compute the materials price variance for December.

b. Compute the materials quantity variance for December.

c. Compute the labor rate variance for December.

d. Compute the labor efficiency variance for December.

e. Compute the variable overhead rate variance for December.

f. Compute the variable overhead efficiency variance for December.

Definitions:

Ratio Analysis

The method of evaluating various financial metrics in a company’s financial statements to assess its performance and financial health.

Size Differences

Variations in the scale or magnitude of entities, often impacting operations, strategies, or market positioning.

EBIT

Stands for Earnings Before Interest and Taxes, and is an indicator of a company's profitability excluding interest and tax expenses.

Depreciation

The accounting method of allocating the cost of a tangible asset over its useful life, reflecting wear and tear, deterioration, or obsolescence.

Q2: A nurse is administering I.V. potassium at

Q2: A new infusion clinic is being started.

Q5: A liquidated corporation will always recognize gain

Q6: A nurse assesses that a client has

Q9: A physician orders parenteral proteins for a

Q12: When preparing to piggyback an antibiotic to

Q169: Ahart Products, Incorporated, has a Transmitter Division

Q243: Arena Corporation manufactures one product. It does

Q305: The following standards for variable overhead have

Q311: Puvo, Incorporated, manufactures a single product in