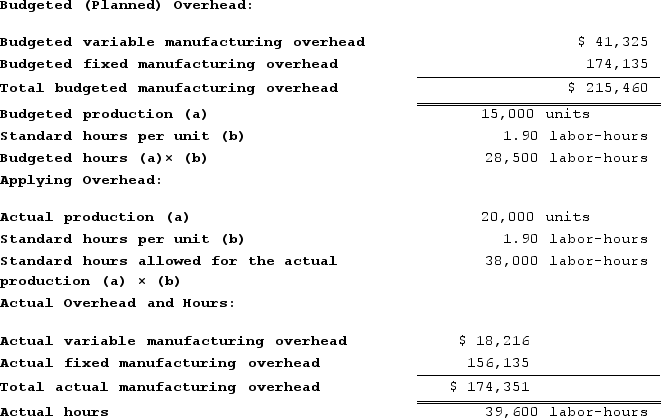

Edlow Incorporated makes a single product--a critical part used in commercial airline seats. The company has a standard cost system in which it applies overhead to this product based on the standard labor-hours allowed for the actual output of the period. Data concerning the most recent year appear below:

Required:

Required:

a. Determine the variable overhead rate variance for the year.

b. Determine the variable overhead efficiency variance for the year.

c. Determine the fixed overhead budget variance for the year.

d. Determine the fixed overhead volume variance for the year.

Definitions:

Overhead

Represents the indirect costs associated with production, such as utilities, rent, and administrative expenses that cannot be directly traced to a specific product.

Direct Expenses

Expenses that can be directly traced to producing specific goods, services, or units of production without any allocation.

Departmental Income Statements

Financial reports that detail the revenue, expenses, and net income for specific departments within an organization.

Service Departments

Units within an organization that provide support services to other departments rather than directly contributing to profit generation.

Q2: Kellems Corporation manufactures one product. It does

Q9: Camps Incorporated has a standard cost system.

Q11: A client complains to a nurse that

Q24: A nurse analyzes a client's laboratory data

Q35: Erica and Brett decide to form their

Q107: In what order should the tests to

Q198: Dirickson Incorporated has provided the following data

Q224: The following standards for variable manufacturing overhead

Q317: At Eady Corporation, maintenance is a variable

Q447: Fluegge Incorporated has provided the following data