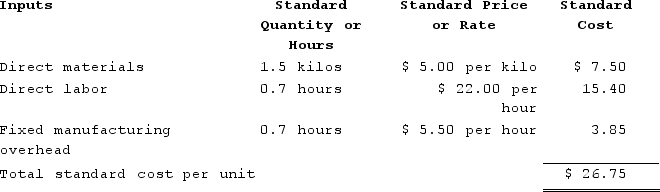

Lusher Corporation manufactures one product. It does not maintain any beginning or ending Work in Process inventories. The company uses a standard cost system in which inventories are recorded at their standard costs and any variances are closed directly to Cost of Goods Sold. There is no variable manufacturing overhead. The standard cost card for the company's only product is as follows:

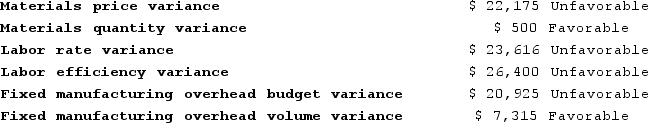

The company calculated the following variances for the year:

The company calculated the following variances for the year:

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $94,325 and budgeted activity of 17,150 hours.

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $94,325 and budgeted activity of 17,150 hours.

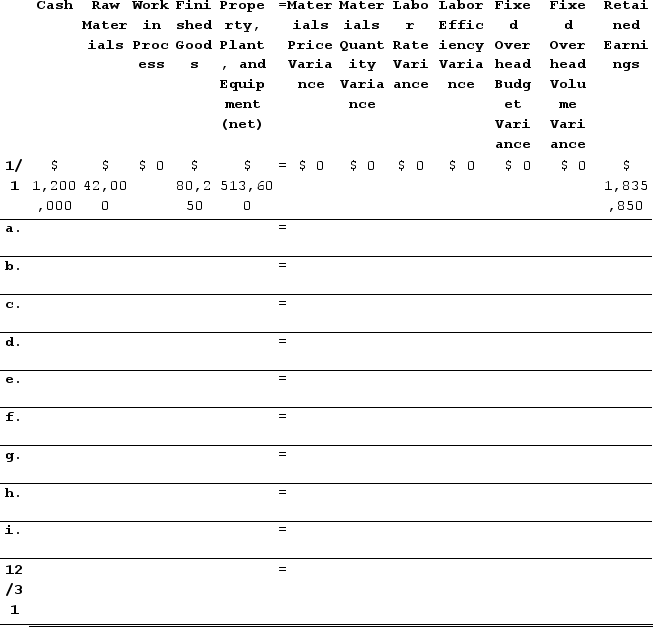

During the year, the company completed the following transactions:Purchased 44,350 kilos of raw material at a price of $5.50 per kilo.Used 39,500 kilos of the raw material to produce 26,400 units of work in process.Assigned direct labor costs to work in process. The direct labor workers (who were paid in cash) worked 19,680 hours at an average cost of $23.20 per hour.Applied fixed overhead to the 26,400 units in work in process inventory using the predetermined overhead rate multiplied by the number of direct labor-hours allowed. Actual fixed overhead costs for the year were $115,250. Of this total, $40,250 related to items such as insurance, utilities, and indirect labor salaries that were all paid in cash and $75,000 related to depreciation of manufacturing equipment.Transferred 26,400 units from work in process to finished goods.Sold for cash 29,200 units to customers at a price of $33.60 per unit.Completed and transferred the standard cost associated with the 29,200 units sold from finished goods to cost of goods sold.Paid $171,000 of selling and administrative expenses.Closed all standard cost variances to cost of goods sold.Required:1. Record the above transactions in the worksheet that appears below. The beginning balances have been provided for each of the accounts, including the Property, Plant, and Equipment (net) account which is abbreviated as PP&E (net).

2. Determine the ending balance (e.g., 12/31 balance) in each account.3. Prepare an income statement for the year.

2. Determine the ending balance (e.g., 12/31 balance) in each account.3. Prepare an income statement for the year.

Definitions:

System Implementation

The process of executing and adopting a new system within an organization, involving configuration, customization, and possibly user training.

Payroll Activities

The administrative tasks involved in processing employee pay, including calculation of wages, withholding taxes, and other deductions.

Computerized

Describing processes or systems that are executed or managed through computers.

Medium Organizations

Organizations that fall between small and large in size, often characterized by the number of employees, annual revenue, or other criteria.

Q5: A pediatric nurse is preparing to administer

Q6: Which of the following statements does not

Q8: A client presents to an emergency department

Q12: A nurse obtains a blood specimen for

Q22: A nurse in a long-term care facility

Q59: How does a partnership make a tax

Q90: Bondi Corporation makes automotive engines. For the

Q100: Kropf Incorporated has provided the following data

Q101: A partnership with a C corporation partner

Q386: Lacrue Incorporated has provided the following data