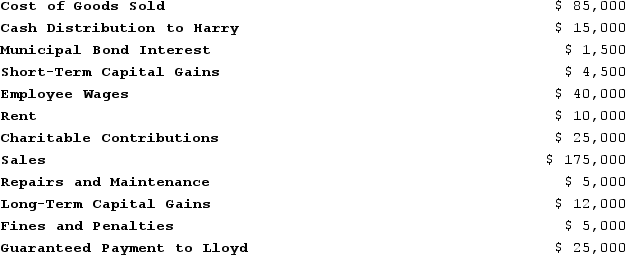

Lloyd and Harry, equal partners, form the Ant World Partnership. During the year, Ant World had the following revenue, expenses, gains, losses, and distributions:

Given these items, what amount of ordinary business income (loss) and what separately stated items should be allocated to each partner for the year?

Given these items, what amount of ordinary business income (loss) and what separately stated items should be allocated to each partner for the year?

Definitions:

Selling Price

The final amount of money charged for a product or service, or the amount the consumer is willing to pay.

Markup Percent

The percentage increase over the cost price of a product to calculate the selling price.

Selling Price

The actual price at which a product or service is sold to the customer.

Camping Equipment

Gear or tools specifically designed for use while camping, including tents, sleeping bags, and portable cooking devices.

Q5: A client with osteomyelitis is admitted to

Q6: If a partner participates in partnership activities

Q16: A nurse is preparing to initiate I.V.

Q29: Hilary had an outside basis in LTL

Q94: Wangerin Corporation applies overhead to products based

Q106: Partners adjust their outside basis by adding

Q113: A valuation allowance is recorded against a

Q134: Alvino Corporation manufactures one product. It does

Q197: Berk Incorporated makes a single product--a critical

Q405: Motts Incorporated has a standard cost system