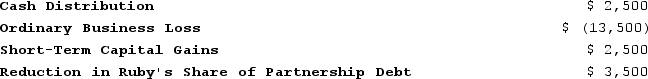

Ruby's tax basis in her partnership interest at the beginning of the partnership's tax year was $13,500. The following items were included in her Schedule K-1 from the partnership for the year:

Determine what amounts related to these items Ruby will report on her tax return assuming her tax basis and at-risk amount are equal and that she is a material participant in the partnership's activities. Further, assume that Ruby and her husband, Gerald, are not involved in any other trade or business and that they file a joint return every year.

Determine what amounts related to these items Ruby will report on her tax return assuming her tax basis and at-risk amount are equal and that she is a material participant in the partnership's activities. Further, assume that Ruby and her husband, Gerald, are not involved in any other trade or business and that they file a joint return every year.

Definitions:

Warrants

Financial derivatives that give the holder the right, but not the obligation, to buy or sell a security at a specific price before a certain date.

Earnings Per Share

A company's profit divided by the number of outstanding shares of its common stock, indicating profitability.

Total Equity

The total of all ownership interests in a company, calculated as the difference between total assets and total liabilities; also known as shareholders' equity or owner's equity.

Bonds Outstanding

Bonds outstanding are the total amount of bonds issued by a company that are not yet redeemed and are currently held by investors.

Q5: A committee is asked to investigate ways

Q11: Frank and Bob are equal members in

Q18: A nurse, assisting a physician with the

Q23: To meet the control test under §351,

Q39: Marlin Corporation reported pretax book income of

Q46: Lynch Company had a net deferred tax

Q54: Which of the following statements about uncertain

Q65: Bingo Corporation incurred a $10 million net

Q80: Remsco has taxable income of $60,000 and

Q132: Robins Corporation manufactures one product. It does