Alfred, a one-third profits and capital partner in Pizzeria Partnership, needs help in adjusting his tax basis to reflect the information contained in his most recent Schedule K-1 from the partnership. Unfortunately, the Schedule K-1 he recently received was for Year 3 of the partnership, but Alfred only knows that his tax basis at the beginning of Year 2 of the partnership was $23,000. Thankfully, Alfred still has his Schedule K-1 from the partnership for Years 1 and 2.

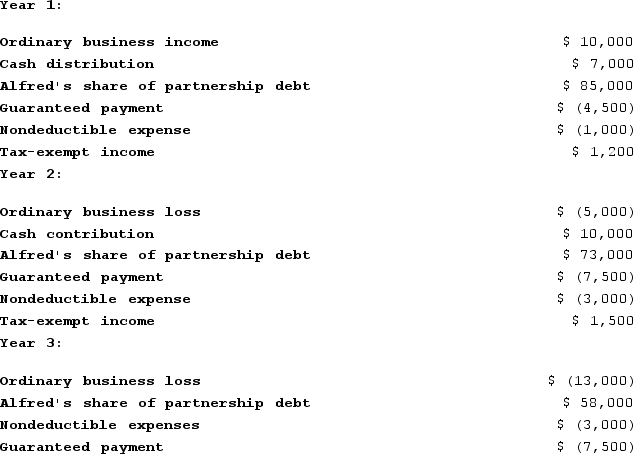

Using the following information from Alfred's Year 1, Year 2, and Year 3 Schedule K-1, calculate his tax basis the end of Year 2 and Year 3.

Definitions:

Examining Table

A piece of equipment used in medical settings, designed for patients to sit or lie on during a medical examination or procedure.

Examination Rooms

Designated spaces in healthcare facilities where medical examinations, procedures, or consultations take place.

Examining Table Cover

A protective layer used to cover an examining table in a medical setting, enhancing hygiene and preventing direct contact between the table and the patient.

Patient Load

The number of patients under the care of a healthcare provider or facility at a given time.

Q1: A nurse is planning for the discharge

Q4: A nurse sends a client's blood specimen

Q6: Robinson Company had a net deferred tax

Q15: ASC 740 requires a publicly traded company

Q18: A client is scheduled for surgical insertion

Q33: Samples Corporation manufactures one product. It does

Q62: Loon, Incorporated reported taxable income of $650,000

Q85: Federal income tax expense reported on a

Q92: Which of the following forms of earnings

Q120: Which of the following statements best describes